European Tech Weekly (Series A & beyond) - Week 10

20 European funding rounds announced last week

Welcome to the latest edition of European Tech Weekly, a newsletter that provides a summary of funding rounds (Series A and beyond) in Europe on a weekly basis.

About the author - my name is Chirag Modi and I am a tech investor based in London, UK. I am fascinated by technology and strive to learn from founders, operators, and fellow investors. You can reach me elsewhere on Linkedin and Twitter.

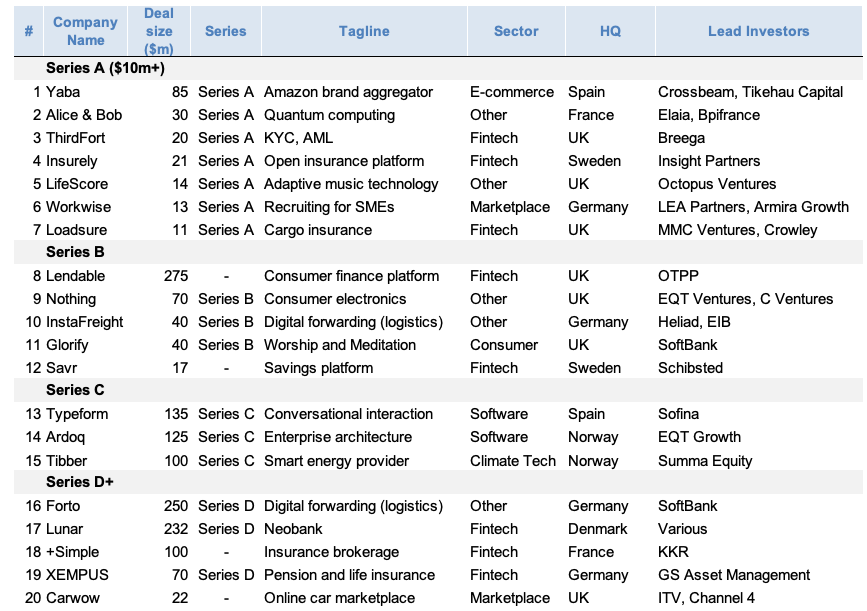

Funding Announcements in Europe by Stage

Note: Minimum deal size of $10m; excludes several sectors such as biotech; non-exhaustive

Company Profiles - Series A

Yaba (Spain | $85m Series A | E-commerce | Crossbeam, Tikehau Capital)

Founded in 2020 and headquartered in Spain, Yaba is an Amazon brand aggregator. It raised $85m in Series A equity and debt funding co-led by Crossbeam and Tikehau Capital.

According to finsmes, “Yaba has acquired 12 brands, generating a turnover of more than $20m. These include Banbaloo, a brand of bed guards for infants, and Superscandi, a Swedish brand of eco-friendly wiping cloths.”

Sources: Finsmes

Alice&Bob (France | $30m Series A | Other | Elaia, Bpifrance)

Founded in 2020 and headquartered in France, Alice&Bob is a quantum computing startup. It raised $30m in Series A funding co-led by Elaia and Bpifrance.

According to the company, “until now, errors were the main barrier to impactful quantum computers. Alice&Bob’s unique technology of self-correcting superconducting quantum bit, the cat qubit, allows for a much simpler road to fault-tolerant and universal gate-based quantum computing. They are currently developing their first logical qubit out of cat qubit. From there they will use a modular approach to scale up.”

Sources: Techcrunch

ThirdFort (UK | $20m Series A | Fintech | Breega)

Founded in 2017 and headquartered in the UK, Thirdfort enables property and legal businesses to onboard individual and corporate clients securely, within minutes. It raised $20m in Series A funding led by Breega.

According to Techcrunch, “The product today comes in two parts. First, there is the “risk engine” built for its business clients, which can be used both for KYC checks as well as to help companies comply with AML regulations. There are around 700 businesses already using the platform. Second, there is an app built for consumer customers of those businesses. This has been built on open banking infrastructure to connect up those businesses with the customer’s bank, by way of the banks’ own banking apps, for payments and related transactions to be made in a secure way. This has now been downloaded some 500,000 times”

According to Mortgagefinancegazette, “the business says it has grown tenfold in both revenue and people since January 2020 and plans to expand its team of 94 to 150 by the end of 2022.”

“The new funding will support growth in its core legal and property markets, adding that the cash will fund expansion into other highly-regulated sectors, such as accountancy, wealth management, and mortgage broking.”

Sources: Techcrunch, Mortgagefinancegazette

Insurely (Sweden | $21m Series A | Other | Insight Partners)

Founded in 2018 and headquartered in Sweden, Insurely is an open insurance platform. It raised $21m in Series A funding led by Insight Partners.

According to Nordic9, “ Insurely has developed a service app that makes it easy for consumers to manage and switch among different insurance products. The company also operates a B2B platform - the Open Insurance solution - a flexible API integration helping insurers, banks, and financial companies access insurance data from as much as 95% of the Swedish insurance market and integrate it into a single point of access for all insurance data.

Customers include Avanza, ICA Försäkring, Lassie and Hedvig.”

Sources: Nordic9

LifeScore (UK | $14m Series A | Other | Octopus Ventures)

Founded in 2018 and headquartered in the UK, LifeScore is an adaptive music platform that creates unique, real-time soundtracks for every journey. It raised $14m in Series A funding led by Octopus Ventures.

According to Tech.eu, “LifeScore’s patented Cellular Composition platform uses AI to transform ‘cells’ pre-recorded at Abbey Road Studios by top-notch musicians on some of the world’s finest instruments using ambisonic microphones, to layer, sequence, mix, and deliver the final output.

Noting that the technology has a wide range of applications across AR and other simulated environments including, live streaming, gaming, automotive, sleep, fitness, health, and wellness, LifeScore's technology has already been incorporated into a Bentley demonstration vehicle and recently signed a deal with Audi.”

Source: Tech.eu

Workwise (Germany | $13m Series A | Marketplace | LEA Partners, Armira Growth)

Founded in 2015 and headquartered in Germany, Workwise operates a digital job marketplace for students. It raised $13m in Series A funding co-led by LEA Partners and Armira Growth.

According to Nordic9, “Workwise provides companies with a free applicant management system that can be used to digitize and accelerate recruiting processes. The company says it handles business for around 2,000 customers and the platform has around 300,000 registered users.”

According to Tech.eu, “the new funds will be used primarily for faster scaling, further development of the product and expansion of the team. By the end of 2022, the startup plans to grow from 140 to 200 employees, and then to 300 by next year.”

Loadsure (UK | $11m Series A | Fintech | MMC Ventures, Crowley)

Founded in 2018 and headquartered in the UK, Loadsure is a provider of a transactional cargo insurance platform. It raised $11m in Series A funding co-led by MMC Ventures and Crowley.

According to Insurancejournal, today, “60 to 90% of cargo in transit is under or uninsured, in part because traditional insurance can’t keep pace with the just-in-time supply chain, the company explained. As a result, many freight brokers, shippers, and carriers are operating with broad risk exposure, especially small-to-medium-sized businesses, which have historically been underserved by the insurance industry, Loadsure added. […] By digitalizing the full cargo insurance life cycle, Loadsure delivers one-click coverage to the U.S. freight industry, and offers an international, per-shipment insurance API. A Lloyd’s coverholder, Loadsure leverages AI and automation to provide an industry pay-as-you-go, digital insurance for brokers, shippers, and carriers.”

Sources: Insurancejournal

Disclaimer

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.