European Tech Weekly (Series A & beyond) - Week 13

20 selected European funding rounds announced last week

Welcome to the latest edition of European Tech Weekly, a newsletter that provides a summary of Series A+ funding rounds in Europe on a weekly basis.

About the author - my name is Chirag Modi and I am a tech investor based in London, UK. I am fascinated by technology investing in private as well as public markets and strive to learn from founders, operators, and fellow investors. You can reach me elsewhere on Linkedin and Twitter.

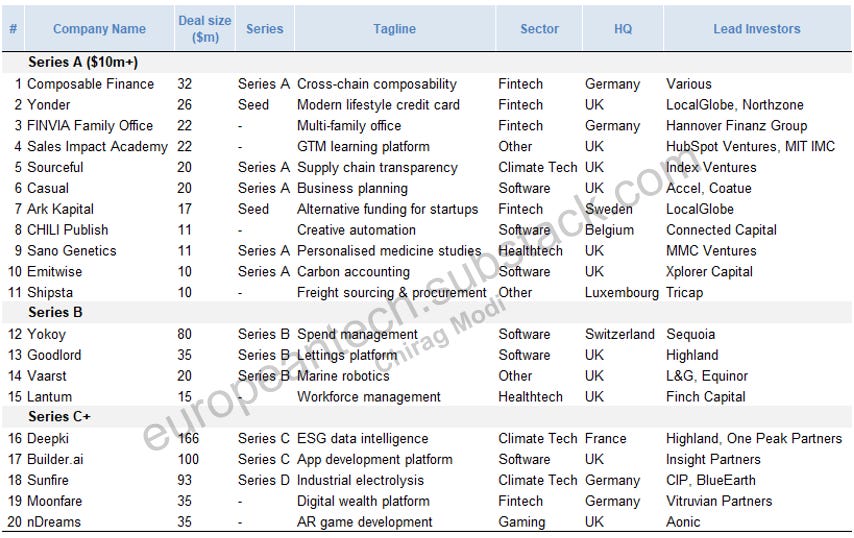

Funding Announcements in Europe by Stage

Note: Minimum deal size of $10m; also includes large seed rounds; excludes several sectors such as biotech; non-exhaustive

Company Profiles - Series A

Composable Finance (Germany | $32m Series A | Fintech | Various)

Founded in 2021 and headquartered in Germany, Composable Finance is creating infrastructure to unlock the multi-layer, and multi-chain future of Ethereum, and other layer 1 blockchains. It raised $32m in Series A funding from investors including GSR, Tendermint Ventures, Fundamental Labs, Coinbase Ventures, LongHash Ventures, Figment VC, New Form Capital, Blockchain Capital, Yunt Capital, Jump Capital, Polytope Capital, NGC Ventures, SOSV, and Spartan Group.

The fundraising comes after the successful procurement of two parachains, both on Polkadot (Composable Parachain) and Kusama (Picasso Parachain). Composable has also built out its offering with Mosaic, its transfer-availability layer, Centauri, the IBC Substrate bridge to the Cosmos ecosystem, and Pablo, our next-generation decentralized exchange on Picasso.

The new capital will be used to expand the team and build products that push the blockchain and Web3 industry further along the continuum of interoperability. Futuristic capabilities like cross-chain computing, with smart contracts that span multiple ecosystems, and developers that spin up protocols that securely handle institutional throughput, are a reality through Composable’s cross-chain virtual machine (XCVM) and Routing Layer.

Sources: Press release

Yonder (UK | $26m seed round | Fintech | LocalGlobe, Northzone)

Founded in 2020 and headquartered in the UK, Yonder is a rewards credit card. It raised $26m in seed funding co-led by LocalGlobe and Northzone.

According to Siliconcanals, “Yonder offers a rewards programme designed around people’s lifestyles, inspired by hundreds of user research sessions with Londoners from around the globe to learn how they really spend their time and money.

The company’s credit card will provide members with access to exclusive drinking, dining and leisure experiences with partners including The Gladwin Brothers and Kricket restaurants, plus the ability to spend abroad with zero FX fees.

Yonder’s approach is to evaluate credit suitability, which is based on transaction data, using open banking to build a more nuanced, personalised picture of its customers’ spending habits than relying on traditional credit checks alone. Yonder secured FCA authorisation in just nine months.

Joining Chong on his mission to transform customers’ relationships with credit are co-founders Theso Jivajirajah and Harry Jell, also of ClearScore, alongside senior talent from Monzo and Wise.”

Source: Siliconcanals

FINVIA Family Office (Germany | $22m round | Fintech | Hannover Finanz Group)

Founded in 2020 and headquartered in Germany, Finvia is a tech-enabled multi-family office. It raised $22m in funding led by Hannover Finanz Group.

FINVIA has developed its own tech platform for wealth managers and family offices, covering asset allocation to controlling and reporting.

Within less than two years, FINVIA has already managed more than 3.5 billion euros on the digital platform.

Sources: Press release

Sales Impact Academy (UK | $22m Series A | Other | Hubspot Ventures, MIT IMC)

Founded in 2019 and headquartered in the UK, Sales Impact Academy is a go-to-market learning platform. It raised $22m in funding co-led by HubSpot Ventures and MIT Investment Management Company.

According to tech.eu, “the SIA technology platform coupled with its live curriculum, taught by the world's elite go-to-market practitioners, is currently used by the likes of HubSpot, Gong, Klaviyo, GitHub, G2, and 6sense.

The fresh capital will enable the startup to develop more curriculum and continue to build out their underlying learning technology platform.”

Source: Tech.eu

Sourceful (UK | $20m Series A | Climate Tech | Index Ventures)

Founded in 2020 and headquartered in the UK, Sourceful is an all-in-one platform for sustainable sourcing. It raised $20m in Series A funding led by Index Ventures, which also led the last round.

According to Techcrunch, Sourceful “works with brands to shrink the environmental damage associated with their product sourcing choices in areas like packing, via offering a marketplace of vetted suppliers. The startup also takes on logistics, handling the buying and shipping piece for brands (including a little warehousing if they need it) — monetizing by taking a commission on the overall price.

Sourceful has around 30 customers since it launched the platform in Q1.

The Series A funding will go on fuelling the platform’s expansion into international markets, growing its presence in Europe, Asia and the U.S. — including a plan to double the size of its 65-strong team within the next two years.”

Sources: Techcrunch

Casual (UK | $20m Series A | Software | Accel, Coatue)

Founded in 2019 and headquartered in the UK, Casual is a collaborative business software platform for financial modelling. It raised $20m in Series A funding led by Accel and Coatue.

“Despite being used every day across the globe, spreadsheets haven’t fundamentally evolved over the past 40 years,” said Casual co-founder and CEO Taimur Abdaal.

“Spreadsheet models are hard to build and maintain, disconnected from the rest of a company’s tech stack, and actively hinder collaboration across teams.

“We’re building a next-generation tool to solve these problems and are delighted that Coatue and Accel have led our Series A to take the company into the next stage of growth”.

Casual will use the funding to expand the team from 12 staff members up to 50 by the end of the year. This will be across all departments, including sales, product, engineering, customer success, and marketing.

Source: UKTN

ArK Kapital (Sweden | $17m Seed | Fintech | LocalGlobe)

Founded in 2021 and headquartered in Sweden, ArK Kapital is a precision financing company that empowers technology businesses to grow faster, enables owners to maintain control, and reduces the risk for investors. It raised c.$17m (and $165m in debt) led by LocalGlobe.

The founding team includes six-time entrepreneur Oliver Hildebrandt (CEO), veteran banker Axel Bruzelius (COO), and Spotify’s ex-VP of Analytics and former EQT Ventures partner Henrik Landgren (CPTO).

According to IBSIntelligence, “the firm targets early-stage, tech-driven companies predicted to grow super-fast but not yet profitable. ArK uses its artificial intelligence (AI) platform to analyze a company’s business health and offer a suite of AI-powered financial and intelligence products. The firm shares daily access to its analytics and insights in a borrower dashboard so that companies can optimize their business performance.

At the seed stage, it’s common for founders to part with 20-25% of their company when taking equity-based funding. Offering an alternative to this, ArK will initially focus on non-dilutive loans to multi-sector European startups ranging from €1 million-10 million. Typically, loans are short-term and must be repaid within two years, which doesn’t give early-stage startups enough time to grow. ArK solves this problem by offering long-term loans lasting up to seven years, unique to every company; the loans are based on predictions of a company’s future revenue.”

A good discussion on the business model can be found here.

Sources: Ibisintelligence

CHILI Publish (Belgium | $11m Series A | Software | Connected Capital)

Founded in 2010 and headquartered in Belgium, CHILI publish is a cloud-based Creative Automation platform that enables brands and agencies to create, edit and share visual content through secure graphic templates - in accordance with brand guidelines — that can be used across in-house teams and agency partners. It raised $11m in Series A funding led by Connected Capital.

Smart Templates in CHILI publisher allow graphic professionals, brands, and agencies to:

connect original creative designs with built-in channel requirements

integrate consumer or product data intelligence

produce on-brand content quickly

deliver ready-to-use graphics for high-volume, data-driven, multichannel campaigns

Pre-approved templates reduce administrative overhead, approval cycles, and production bottlenecks. This frees up creative teams to focus on higher-value creative work, while allowing agencies to leverage the automation features into new revenue and business models

This fresh round of funding will be used to accelerate solution and community development, attract new talent and boost the company’s go-to-market and sales operations in the United States and Europe.

Source: Press release, Connected Capital

Sano Genetics (UK | $11m Series A | Healthtech | MMC Ventures)

Founded in 2016 and headquartered in the UK, Sano Genetics provides a software platform to connect patients with research opportunities. It has raised $11m in Series A funding led by MMC Ventures.

According to tech.eu, “drug development takes 10-15 years and many medicines never make it out of R&D because recruitment is painful, participant dropout rates are high and costs are prohibitive.

Attempting to change this, the company has developed a software platform that connects patients living with rare and chronic conditions such as Long Covid, multiple sclerosis, Parkinson’s and Alzheimer’s, directly with biotech and pharma companies leading personalised medicine research.

This latest round of funding will be utilised to grow its team in the US and Europe, and develop its platform to meet demand in over 50 diseases and over 6 countries by mid-2023.”

Source: tech.eu

Emitwise (UK | $10m Series A | Software | Xplorer Capital)

Founded in 2019 and headquartered in the UK, Emitwise is a provider of carbon accounting software. It raised $10m in Series A funding led by Xplorer Capital.

The carbon accounting platform enables you to measure, report and reduce the carbon footprint of your operations and supply chain. The capabilities include (a) Smart data sourcing, (b) Automated carbon footprinting and (c) Continuous improvement

Sources: Tech.eu

Shipsta (Luxembourg | $10m Series A | Other | Tricap)

Founded in 2019 and headquartered in Luxembourg, Shipsta is an internationally operating logistics software company. It raised $10 in Series A funding led by Tricap.

SHIPSTA’s digital platform connects shippers and carriers to ensure a frictionless procurement process for spot and contract buying of freight, entirely online. By automating complex tasks and providing complete transparency of data, it helps businesses control freight costs, manage risk and build resilience in their supply chain.

With more than 2,000 users all over the world, the platform is already used by some of the world’s largest chemicals, pharmaceuticals and automotive companies.

Sources: Tech.eu

Disclaimer

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.