European Tech Weekly (Series A & beyond) - Week 14

22 selected European funding rounds announced last week

Welcome to the latest edition of European Tech Weekly, a newsletter that provides a summary of Series A+ funding rounds in Europe on a weekly basis.

About the author - my name is Chirag Modi and I am a tech investor based in London, UK. I am fascinated by technology investing in private as well as public markets and strive to learn from founders, operators, and fellow investors. You can reach me elsewhere on Linkedin and Twitter.

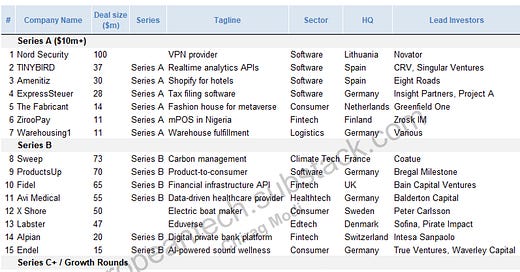

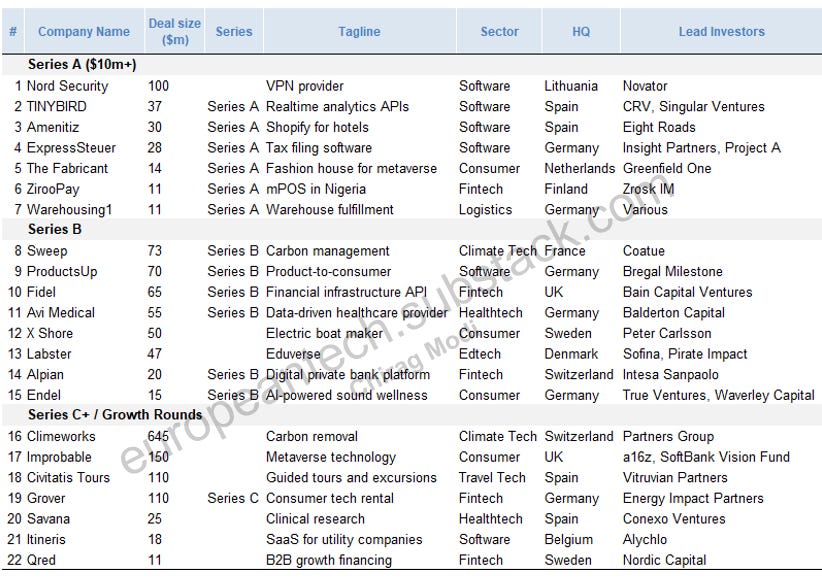

Funding Announcements in Europe by Stage

Note: Minimum deal size of $10m; also includes large seed rounds; excludes several sectors such as biotech; non-exhaustive

Company Profiles - Series A

Nord Security (Lithuania | $100m funding | Other | Novator)

Founded in 2012 and headquartered in Lithuania, Nord Security is the leader in providing digital security and privacy solutions for individuals and businesses. It raised $100m in venture funding at $1.6bn valuation led by Novator. The company has been bootstrapped for the last 10 years.

The company offers the following products:

NordVPN: VPN solution used by 15 million customers

NordPass - a password manager

NordLocker - a file encryption tool

NordLayer - network access security for businesses

NordWL - Provide our infrastructure, know-how, and tools for businesses that want to build their own VPN products.

Sources: Techcrunch

2. Tinybird (Spain / US | $37m Series A | Software | CRV, Singular Ventures)

Founded in 2019 and headquartered in Spain / US, Tinybird helps developers and data teams build data products over analytical data, at any scale. It raised $37m in Series A funding co-led by CRV and Singular Ventures.

The platform is helping businesses realize the full potential of their data at any scale by turning it into real-time insights, actions, and business value. Developers can build data products that make use of our low-latency, high-concurrency APIs - in minutes, not weeks. The product is used by start-ups through global enterprises including Vercel, The Hotel Network, and Keyrock.

"Several of our customers are reading over 1.5 trillion rows on average per day via Tinybird and ingesting around 5 billion rows per day, others are making an average of 250 requests per second to our APIs querying several billion row datasets," Jorge Gomez Sancha told Techcrunch in an interview last year.

The company plans to expand its team in the U.S. and ramp up its product and sales teams.

Source: Techcrunch

3. Amenitiz (Spain | $20m Series A | Software | Eight Roads)

Founded in 2017 and headquartered in Spain, Amenitiz is an all-in-one platform to help owners grow and manage their vacation properties. It raised $20m in Series A funding led by Eight Roads.

According to Techcrunch, “as well as enabling day-to-day ops, such as guest management, communication and invoicing — including Amenitiz’s own brand payment module — the fully integrated software platform includes a website builder and a channel manager.”

The company has scaled its PMS SaaS bundle to serve 4,000+ properties across 37 countries (3,000 in Nov-21).

“The new funding will be used to expand into more European markets and launch more products on its platforms — along with further scaling the size of Amenitiz’s team, with a plan to grow from 150 people to around 350 by the end of this year.”

Sources: Techcrunch

4. ExpressSteur (Germany | $28m Series A | Software | Insight, Project A)

Founded in 2019 and headquartered in Germany, ExpressSteuer is a tax filing platform. It raised $28m in Series A funding led by Insight Partners and Project A.

According to EU-startups, “using an AI-powered backend system, ExpressGroup enables platform partners such as accounting firms, tax consultants, and lawyers to process tax cases in a few minutes.”

“The first product (tax filing) was well received by the target audience allowing the company to grow to over €45 million GMV run-rate in under 12 months. After seeing promising growth in Germany, ExpressGroup has set its sight on the large EU tax market. The new funding will be used to grow the organization internationally and launch adjacent products in more fintech verticals.

Source: EU-Startups

5. The Fabricant (Netherlands | $14m Series A | Consumer | Greenfield One)

Founded in 2018 and headquartered in the Netherlands, The Fabricant is a decentralized digital fashion house building the wardrobe of the metaverse. It raised $14m in Series A funding led by Greenfield One.

According to Venturebeat, “the company’s ultimate mission is to build a decentralized fashion house that will dress the population of the metaverse and create a more equitable, creative and sustainable fashion industry. The Fabricant Studio allows anyone to create, trade, and wear digital-only garments.”

“The funding is being used to support and expand the company’s initiative to build the “wardrobe of the metaverse” through its co-creation and non-fungible token (NFT) platform, The Fabricant Studio.”

Sources: Techcrunch

6. ZirooPay (Finland / Nigeria | $11m Series A | Fintech | Zrosk IM)

Founded in 2014 and headquartered in Finland / Nigeria, ZirooPay is a provider of POS terminals in Nigeria. It raised $11m in Series A funding led by Zrosk Investment Management.

ZirooPay provides internet-free, easy-to-use POS terminals. ZirooPay simplifies the process of receiving payments, sales tracking, and inventory management for businesses in Nigeria.

According to the company over 15,000 merchants use its POS terminals and mobile application. These merchants have processed $500 million — a 5,000% increase within three years — across 10 million transactions, the company continued. This new capital will be deployed toward expanding its payment infrastructure, accelerating growth, and growing its team, the company said.

Source: Techcrunch

7. Warehousing1 (Germany | $11m Series A | Logistics | Various)

Founded in 2018 and headquartered in Germany, Warehousing1 is a logistics startup. It raised $11m in Series A funding from Schenker Ventures, Aster Capital, and Wille Finance and existing investors such as HV Capital and Base10 Partners.

According to tech.eu, “the startup offers warehousing and fulfillment networks in Europe with over 850 locations. According to the company, it enables the integration of various shop systems with warehouse management systems. In doing so, the company is digitalizing the management of the entire fulfillment process, even for systems and system combinations where the options for digital control were previously limited.”

Sources: Tech.eu

Disclaimer

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.