European Tech Weekly (Series A & beyond) - Week 17

18 selected European funding rounds announced last week

Welcome to the latest edition of European Tech Weekly, a newsletter that provides a summary of Series A+ funding rounds in Europe on a weekly basis.

About the author - my name is Chirag Modi and I am a tech investor at Atomico, a multi-stage VC fund. I back exceptional founders at Series B and beyond and would love to discuss potential opportunities. You can reach me via email (chirag[at]atomico.com) or Linkedin.

Separately, I am currently spending some time on the voluntary carbon market. I would love to chat with investors that have spent time on this topic as well as founders that are building businesses targeting / adjacent to VCM.

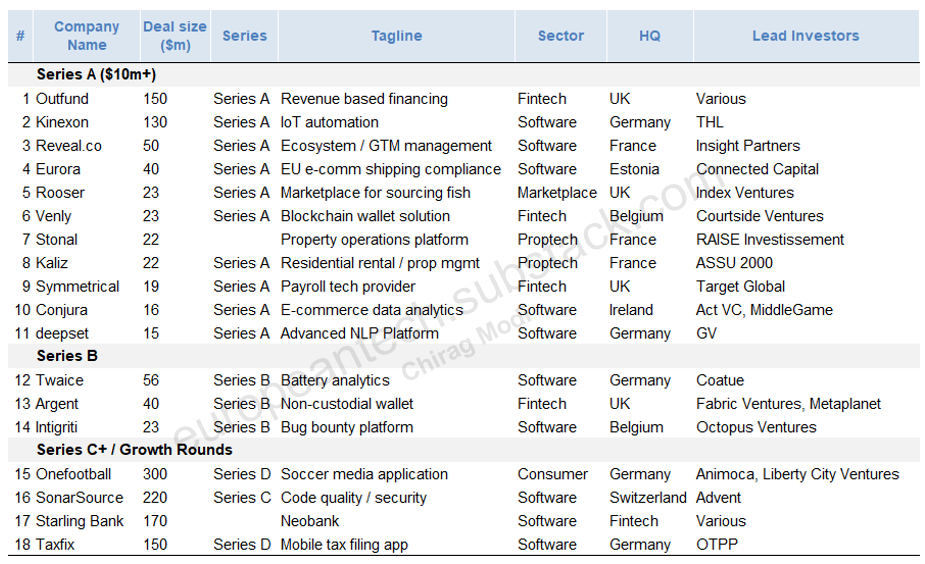

Funding Announcements in Europe by Stage

Note: Minimum deal size of $10m; also includes large seed rounds; excludes several sectors such as biotech; non-exhaustive

Company Profiles - Series A

Outfund (UK | $150m Series A | Fintech | Various)

Founded in 2018 and headquartered in the UK, Outfund is a revenue-based finance provider to online businesses. It raised $150m in Series A funding (debt and equity) led by Force Over Mass, PostFinance, 1818 Venture Capital and Tribe Capital.

According to tech.eu, “With this new funding, the startup will loan over £500 million to 5,000 businesses in the next 12 months, and will increase its lending limit to £10 million per company".”

“Outfund claims it can deploy between £10,000 and £10 million of funding and is available to businesses that take online payments, have a minimum of £10,000 monthly turnover, and have been trading for at least six months.”

Sources: Tech.eu

2. Kinexon (Germany | $130m Series A | Software | THL)

Founded in 2012 and headquartered in Germany, Kinexon develops sensing and software solutions for the IoT vertical. It raised $130 in Series A funding led by THL.

“KINEXON provides cloud software that captures, optimizes and automates processes in manufacturing, logistics, and sports. Operating under two core segments, (a) KINEXON Industries and (b) KINEXON Sports & Media, the company’s full Internet of Things (“IoT”) stack product portfolio combines software with any sensors and connected devices, creating an end-to-end solution for automation.

KINEXON Industries’ technology enables companies like BMW, Continental, Siemens, and Airbus to improve productivity as well as sustainability and reduce costs in manufacturing and logistics.

In sports, KINEXON’s automated real-time content generation enables the analysis of athletic performance as well as the enrichment of sports broadcasts with novel data, for example for augmented reality applications. Through its work with FIFA and 80% of the NBA teams in the field of live player and ball tracking, KINEXON enables real-time insights into conditioning, performance, and game strategy.”

The company has more than 300 employees across offices in Munich and Chicago. According to finsmes, “the company intends to use the funds to accelerate international expansion and scale its operating system for connected and automated operations.”

Source: Press release, Finsmes

3. Reveal (France | $50m Series A | Software | Insight Partners)

Founded in 2020 and headquartered in France, Reveal is the platform for Partnership, Marketing, and Sales teams to generate revenue through their ecosystem. It raised $50m in Series A funding led by Insight Partners.

According to Techcrunch, “Reveal ingests data from existing customer relationship management systems to identify common sales accounts as well as potential new leads. Algorithms attempt to identify the top partners to add to a company’s ecosystem, even if the company isn’t directly connected to them.”

“Reveal’s future plans include tripling its 40-employee headcount (within the next 18 months), investing in product development and expanding its online learning hub for partnership professionals. Over the long term, Bouchez hopes to build the largest network of “connected companies,” with the tentative goal of eclipsing 20,000 companies by the end of 2023.”

Sources: Techcrunch

4. Eurora (Estonia | $40m Series A | Software | Connected Capital)

Founded in 2018 and headquartered in Estonia, Eurora is a cross-border compliance platform. It raised $40m in Series A funding led by Connected Capital.

Changes in EU regulation regarding import duty, coupled with the e-commerce boom, have led to an increased need for shipping compliance.

According to TechCrunch, “Eurora’s approach has been to build a platform that operates as a kind of AI-based tax maven, more technically referred to as a “VAT intermediary.”

“If you are buying online, the tax and duties are [often filled out] wrong. Our machine makes sure it’s right,” said Lastik in an interview. “Everything going before and after the declaration is right. This is a machine. You no longer need to ensure you have every parcel declared correctly.”

Eurora currently has 200 paying customers.

Source: Techcrunch

5. Rooser (UK | $23m Series A | Marketplaces | Index Ventures)

Founded in 2019 and headquartered in the UK, Rooser connects seafood buyers and suppliers, giving them the right tools to trade efficiently, negotiate prices and process deliveries across Europe. It raised $23m in Series A funding led by Index Ventures.

According to Techcrunch, “today the company’s focus is on stock management, providing tools to help suppliers manage this, as well as to handle and track sales and assess the wider marketplace for their products. Soon, the plan will be to incorporate more quality control tools, supply chain finance, and personalization for buyers and sellers to connect more likely trades; and, further down the line, the startup will also bring more business intelligence and analytics into the mix for its customers.

It currently has some 45 “species” on sale totalling more than 71,000 kilograms, but does not disclose specific customer numbers apart from noting that it has more than 300 active users and has enabled some 50,000 transactions to date (its business model is to take a commission on each transaction).”

The funding will be used both to expand into more markets and to continue building more functionality into its platform.

Sources: Techcrunch

6. Venly (Belgium | $23m Series A | Fintech | Courtside Ventures)

Founded in 2018 and headquartered in Belgium, Venly is a blockchain-agnostic provider with wallet, NFT and marketplace services, among others. It raised $23m in Series A funding led Courtside Ventures.

“Venly creates powerful tools and products empowering Web2 businesses to leverage Web3 technology and integrate it seamlessly into their own business processes without sacrificing user experience or security. It offers brands, games, and platforms easy to implement blockchain tech like digital wallets for their end-users.

Their intuitive API platform delivers groundbreaking innovation to prominent companies in the blockchain gaming space, including The Sandbox, Aavegotchi, Bondly, Shopify, and other industry leaders.”

The platform has surpassed 2 million users. Venly will use the funding to develop products centred around new benefits to Web3 users, with a close focus on gaming as well as eCommerce.

Source: Press release

7. Stonal (France | $22m Series A | Proptech | Raise)

Founded in 2017 and headquartered in France, Sonal is a property operations SaaS platform, It raised $22m in Series A funding led by Raise.

“Stonal enables commercial and residential buildings to be managed more efficiently by offering property-owners and asset managers a SaaS platform capturing their entire portfolio.”

“In 2021, Stonal reached $11 million in revenues and became profitable. Stonal helps more than 130 clients, REITs, insurers, social housing organizations, asset managers, and family offices, to manage a combined portfolio of more than 200 million sqm throughout Europe.

The $22 million investment from RAISE Investissement and existing shareholders will enable Stonal to invest further in its product and technology platform, expand into Germany and the United Kingdom and add 50 talented employees to the existing 120-person team. The company's ambition is to reach $100 million in revenues within five years, taking advantage of the ageing IT infrastructure among major real estate asset managers.”

Sources: Press release

8. Kaliz (France | $22m Series A | Proptech | Various)

Founded in 2020 and based in France, Kaliz specialises in rental management. It raised $22m in Series A Funding (debt and equity) led by ASSU 2000.

Kaliz has developed its own technological tools to simplify rental management for owners: (a) process automation, (b) financial performance indicators of the rental stock, (c) follow-up of outstanding actions (claims resolution, search for tenants, etc.)

The company manages more than 2,700 lots on behalf of nearly 800 owners throughout France. It plans to exceed the threshold of 4,000 lots by December 2022, i.e. an acquisition rate of more than 200 new lots per month.

In addition, Kaliz is currently conducting advanced discussions with a dozen major players in the banking and real estate sectors to further increase this pace of acquisitions.

Source: News

9. Symmetrical (UK | $19m Series A | Fintech | Target Global)

Founded in 2019 and headquartered in the UK, Symmetrical is a payroll tech provider. It raised $18.5m in Series A funding led by Target Global.

From a compliance perspective, it can be challenging for HR departments to pay people abroad — particularly if those employees have domestic residences.

To address some of the problems plaguing payroll, Symmetrical offers tools designed to help employers access, analyze and manage salary data. Using the API-based platform, managers can approve salaries for domestic and international employees as well as deductions and ad hoc payments, routing data into the relevant systems of record.

Symmetrical has rivals in vendors including Payfit, SeamlessHR, Papaya Global and Everee. But the company, which has a customer base of over 50 companies and annual recurring revenue eclipsing $1 million, sees legacy payroll providers such as ADP and Paychex and “traditional enterprise payroll software vendors” (e.g., SAP SuccessFactors) as its top competitors.

The proceeds will support Symmetrical’s expansion into new European markets and enterprise clients.

Sources: Techcrunch

10. Conjura (Ireland | $16m Series A | Software | Act VC, MiddleGame Ventures)

Founded in 2018 and headquartered in Ireland, Conjura is an e-commerce data analytics platform. It raised $16m in Series A funding co-led by Act Venture Capital and MiddleGame Ventures,

According to the Irish Times, “Conjura offers data analytics across the entire e-commerce operation on a single cloud-based platform, giving companies better visibility over their operations than previous solutions that offered a more siloed approach with multiple tools. The platform offers real-time analysis, pulling data from fulfilment, warehousing, and supply chain sources and combining it with online/offline sales, marketplace transactions and customer metrics. Among its customers are Naturecan, Wild, Saint+Sofia, Percival, CleanCo and CurrentBody.”

Source: Irish Times

11. Deepset (Germany | $15m Series A | Software | GV)

Founded in 2018 and headquartered in Germany, Deepset is building the next enterprise search engine fueled by NLP and open-source. It raised $15m in Series A funding led by GV.

Deepset is behind the open-source NLP framework Haystack which offers developers ways to build APIs for enterprise search engines that can understand and respond to imprecise wording and specific questions by sorting through connected databases and documents, or summarizing them as needed. In other words, “Haystack lets developers build pipelines for NLP use cases. Originally created for search applications, the framework can power engines that answer specific questions (e.g., “Why are startups moving to Berlin?”) or sift through documents.”

“With the new financing secured, Deepset aims to translate its open-source success — thousands of organizations currently use Haystack — into increased revenue. Rusic (CEO) says that the 30-person, Berlin, Germany-based company was bootstrapped and break even before raising its first funding round in 2021, and now has large enterprise customers including Airbus.”

Sources: Techcrunch

Disclaimer

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.