European Tech Weekly (Series A & beyond) - Week 15

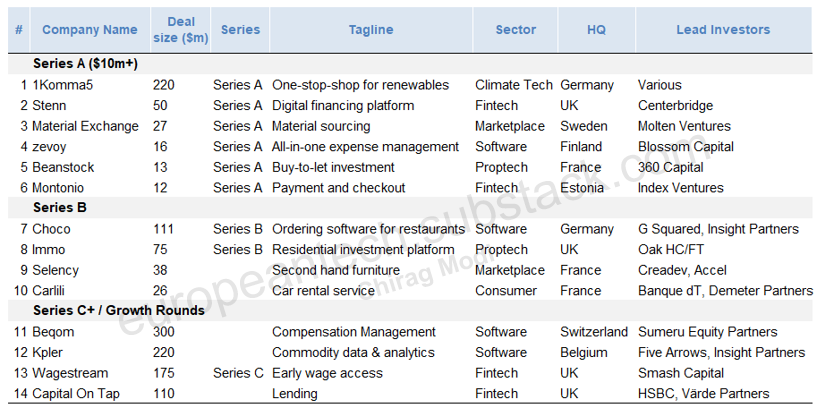

14 selected European funding rounds announced last week

Welcome to the latest edition of European Tech Weekly, a newsletter that provides a summary of Series A+ funding rounds in Europe on a weekly basis.

About the author - my name is Chirag Modi and I am a tech investor based in London, UK. I am fascinated by technology investing in private as well as public markets and strive to learn from founders, operators, and fellow investors. You can reach me elsewhere on Linkedin and Twitter.

Funding Announcements in Europe by Stage

Note: Minimum deal size of $10m; also includes large seed rounds; excludes several sectors such as biotech; non-exhaustive

Company Profiles - Series A

1Komma5 (Germany | $220m Series A | Climat Tech | Various)

Founded in 2021 and headquartered in Germany, 1Komma5 is a digital broker for installers and services related to solar systems, energy storage, and charging stations. It raised $220m in Series A funding from eCapital, BTOV Ventures, Porsche Ventures, French Eurazeo, Blue Elephant Ventures, and the Haniel and Schuerfeld families.

According to Newsroom, “ the start-up has set itself the goal of expanding the market for carbon-neutral energy and air-conditioning technology in private households in a sustainable and decentralized way, thereby accelerating the transition to low-carbon and carbon-neutral energy. The way 1KOMMA5° works is to acquire interests in leading electrical installation companies across Europe with a focus on renewable energies (solar self-supply, heat pumps, energy storage), supporting them with digitalization efforts and the centralization of administrative tasks as well as providing growth capital. At the same time, networking concepts are being developed to make installed devices available for the energy services of the future via proprietary applications and interfaces – for example, smart electricity tariffs and virtual power plant concepts.”

The funding will “support its plan to equip 1.5 million buildings across Europe with carbon-neutral technology for electricity, heating, and mobility by the end of the decade.”

Sources: Porsche, Renewablesnow

2. Stenn (UK | $50m Series A | Fintech | Centerbridge)

Founded in 2015 and headquartered in the UK, Stenn is a trade finance platform for global SMEs. It raised $50 in Series A funding at a $900m valuation led by Centerbridge.

According to UKTN, Stenn “provides invoice financing to small and medium-sized enterprises (SMEs). It uses data and tailored algorithms to analyze credit, fraud, and compliance risks.

The capital provided to SMEs via Stenn’s fintech platform comes from larger financial institutions, including Barclays and HSBC, with Stenn managing the allocation of those funds.”

“Stenn has provided more than $6bn of financing to SMEs in and out of the UK across different sectors including IT services and retail. The new funding will go towards supporting marketing, product development, and expanding its team with the hiring of global talent.”

Source: UKTN

3. Material Exchange (Sweden | $27m Series A | Marketplace | Molten Ventures)

Founded in 2017 and headquartered in Sweden, Material Exchange is a SaaS-enabled marketplace designed to simplify the relationship between footwear and apparel brands and material suppliers. It raised $27m in Series A funding led by Molten Ventures.

According to Vogue business, “material suppliers subscribe to the platform, which allows them to showcase their materials to potential brand partners. Brands subscribe to connect with suppliers while using Material Exchange’s material management system to keep track of materials and workflows in real-time. The company recently launched a mobile app to host its platform.”

The funding will allow Material Exchange to scale its operations globally, adding to its existing offices in Stockholm, India, Armenia, New York, and Dongguan in China, and expanding its C-suite across Stockholm and London

Sources: Tech.eu, Vogue business

4. Zevoy (Finland | $16m Series A | Software | Blossom Capital)

Founded in 2020 and headquartered in Finland, Zevoy is a holistic expense management platform. It raised $16m in Series A funding led by Blossom Capital.

According to tech.eu, “platform aims to create a simple, smart, seamless, and efficient expense management solution for companies. It links smart payment cards to efficient expense management software, saving companies time and money.

In a span of a year, the team has received FSA approvals and launched an all-in-one Visa card running on the Zevoy ecosystem. Going forward, the fintech is expected to secure a Credit Institution license in 2022."

“With the freshly infused capital, the startup plans to roll out operations in eight new markets during the second quarter of 2022.”

Source: Tech.eu

5. Beanstock (France | $13m Series A | Proptech | 360 Capital)

Founded in 2020 and headquartered in France, Beanstock is a buy-to-let investment marketplace. It raised $13m in Series A funding led by 360 Capital.

According to tech.eu, “Beanstock offers retail investors access to the tools and resources needed to finance, acquire and manage buy-to-let properties entirely online. The platform has assisted more than 350 retail investors in their buy-to-let projects and has €50 million in assets under management.

With this latest round, the proptech firm plans to increase its hold on its home turf France. It is already present in 20 French cities and plans to expand its footprint to 30 additional cities by the end of 2022 in Spain, the U.K., Italy, Greece, Belgium, Germany, Portugal, and the Netherlands.”

Sources: Tech.eu

6. Montonio (Estonia | $12m Series A | Fintech | Index Ventures)

Founded in 2018 and headquartered in Estonia, Montonio is an e-commerce checkout solution. It raised $12m in Series A funding led by Index Ventures.

According to tech.eu, “For merchants, the company offers a payment solution based on open banking, one that can cut costs by up to a factor of 100x when compared to traditional mechanisms such as Visa or Mastercard.”

According to Techcrunch, “eventually, Montonio wants to become a one-stop-shop for everything that happens once you click the purchase button. The company calls this process the “post-checkout experience”. For instance, Montonio can also act as an aggregator for different financing solutions.”

Source: Tech.eu, Techcrunch

Disclaimer

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.