European Tech Weekly (Series A & beyond) - Week 11

16 selected European funding rounds announced last week

Welcome to the latest edition of European Tech Weekly, a newsletter that provides a summary of funding rounds (Series A and beyond) in Europe on a weekly basis.

About the author - my name is Chirag Modi and I am a tech investor based in London, UK. I am fascinated by technology and strive to learn from founders, operators, and fellow investors. You can reach me elsewhere on Linkedin and Twitter.

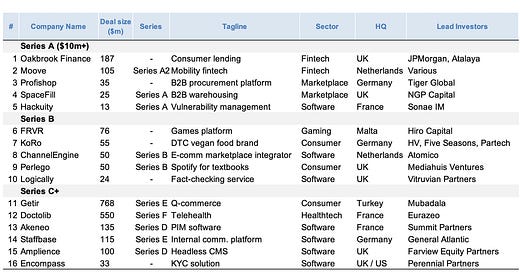

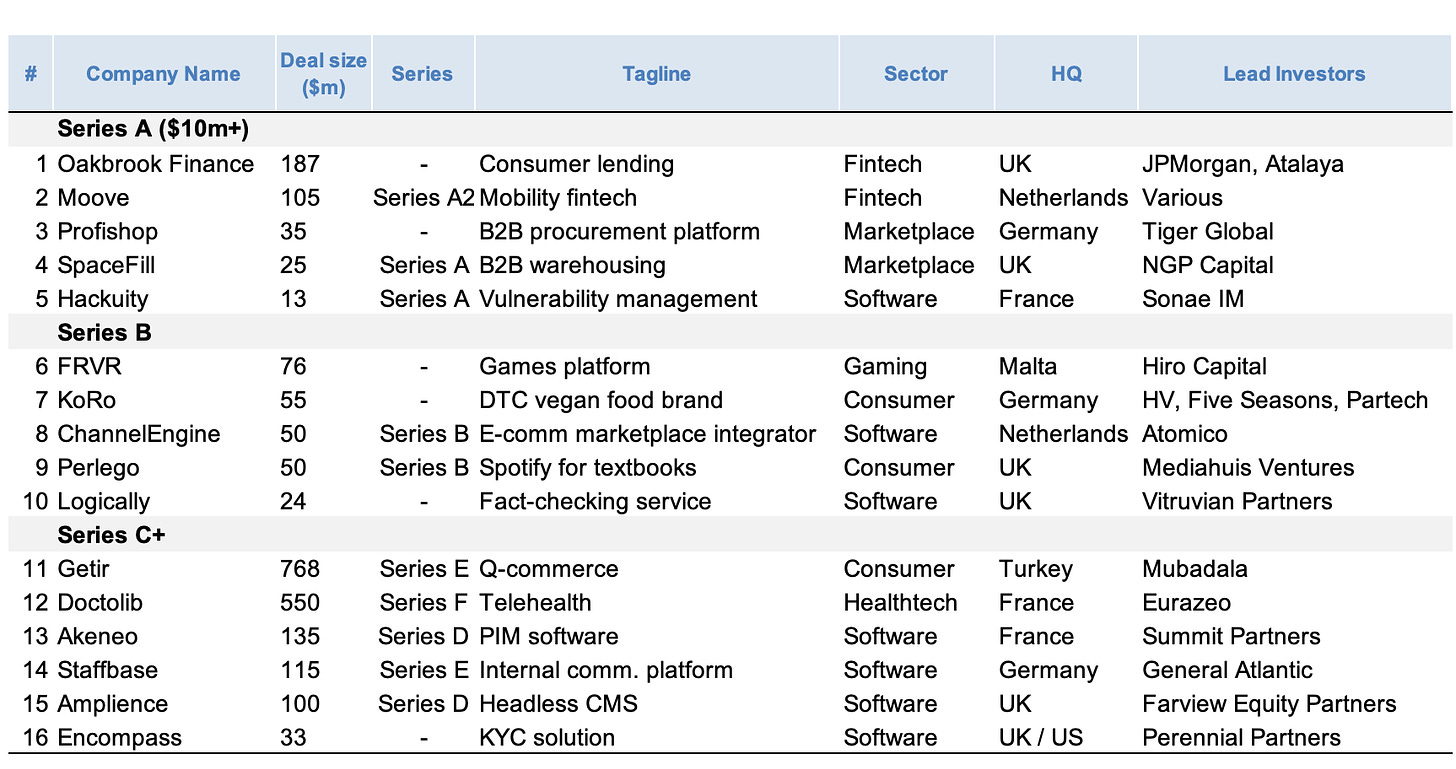

Funding Announcements in Europe by Stage

Note: Minimum deal size of $10m; excludes several sectors such as biotech; non-exhaustive

Company Profiles - Series A

Oakbrook Finance (UK | $187m round | Fintech | JPMorgan, Atalaya)

Founded in 2011 and headquartered in the UK, Oakbrook is a digitally enabled consumer finance and technology business. It raised $187m in a venture round co-led by JPMorgan and Atalaya Capital.

Oakbrook Finance differentiates itself through creating financial instruments specially designed for the near-prime market. They have used technology to develop their product, Likely Loans. This provides clients with a quick online application that confirms if they are eligible for loans, thus not affecting their credit score.

The company has been lending since 2014. Its consumer loan products cover a wide customer spectrum with loan amounts ranging from £500 to £15,000 with APR's as low as 6.9%.

Sources: Press release,

Moove (Netherlands | $105m Series A | Fintech | Various)

Founded in 2019 and headquartered in the Netherlands, Moove is an mobility fintech that provides vehicle financing to drivers of ride-hailing platforms like Uber and other gig networks in Africa. It raised $105m in Series A ($65m equity and $40m debt) from existing investors (Speedinvest, Left Lane Capital, and thelatest.ventures) as well as new investors (AfricInvest, MUFG Innovation Partners, Latitude and Kreos Capital).

According to Techcrunch, “Moove, which deals with new cars, is a flexible option for drivers who want to get into the business of ride-hailing without having to borrow from car owners or take bank loans to finance cars bought from dealerships. The loans are between 12 and 48 months, and when drivers repay them (at an 8% to 13% annual interest rate), they own the cars.”

Sources: Techcrunch

Profishop (Germany | $35m Series A | Marketplacexn | Tiger Global)

Founded in 2012 and headquartered in Germany, Profishop is a B2B procurement platform. It raised $35m in Series A funding led by Tiger Global.

With about 1.5 million SKUs, the B2B procurement platform offers a broad variety of industrial durable and consumer goods for professional users in the fields of construction, industry and the craft sector. Profishop works in cooperation with manufactures, who also send out the merchandise to the customer with no further detours. This simple concept allows it to offer a wide range of goods, while minimizing its own risks and saving warehousing costs.

According to Techcrunch, the company cleared $100 million in sales with 500,000 customers last year, and it’s on track to more than double those numbers this year.”

The equity investment will be used to continue expanding its business and platform in Europe and elsewhere.

Sources: Techcrunch

Spacefill (UK | $25m Series A | Marketplace | NGP Capital)

Founded in 2018 and headquartered in France, Spacefill is a warehousing cloud platform. It raised $25m in Series A funding led by NGP Capital.

According to NGP Capital, “Spacefill disrupts the warehousing market by connecting mid to enterprise sized customers with warehouse partners. Spacefill’s platform enables customers to build, visualize, manage, and optimize their logistics networks, all-in-one place with just one integration to the Spacefill platform.

SpaceFill’s platform is connected to more than 1,500 partners in 6 European countries. Once onboarded, its customers can start building their network by collaborating with one of those partners directly on the platform or by connecting their existing locations.

In two years, Spacefill has become the first European Warehousing Cloud, serving more than 500 customers, and overpassing €10m in revenues and 60 employees in France and Germany.

SpaceFill’s ambition is to become as indispensable for storing goods in supply chains as the Cloud is for storing data online. As such, the company will use this new investment to recruit 80 people, mostly within their engineering department.”

Sources: NGP Capital blog

Hackuity (France | $13m Series A | Software | Sonae IM)

Founded in 2019 and headquartered in France, Hackuity is a risk-based vulnerability management platform. It raised $13m in Series A funding led by Sonae IM.

According to Securitytweek, “it is focused on helping cybersecurity teams identify, prioritize, and resolve vulnerabilities before threat actors start exploiting them. The company’s approach to vulnerability management relies on aggregating all third-party exposure data of its customers into a single place, so as to provide them with a full picture of their security posture.”

“Hackuity plans to invest in its go-to-market strategy, reinforcing its engineering team, maintaining a fast development rate, and further developing its buyer and user communities”

Source: Securityweek

Disclaimer

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.