Welcome to the second edition of European Tech Weekly, a newsletter that provides a summary of Series A+ financing rounds in Europe on a weekly basis.

About the author - my name is Chirag Modi and I am a tech investor based in London, UK. I am fascinated by technology investing in private as well as public markets and strive to learn from founders, operators, and fellow investors. You can reach me on Linkedin, Twitter, or via email (chirag [at]cmodi.com).

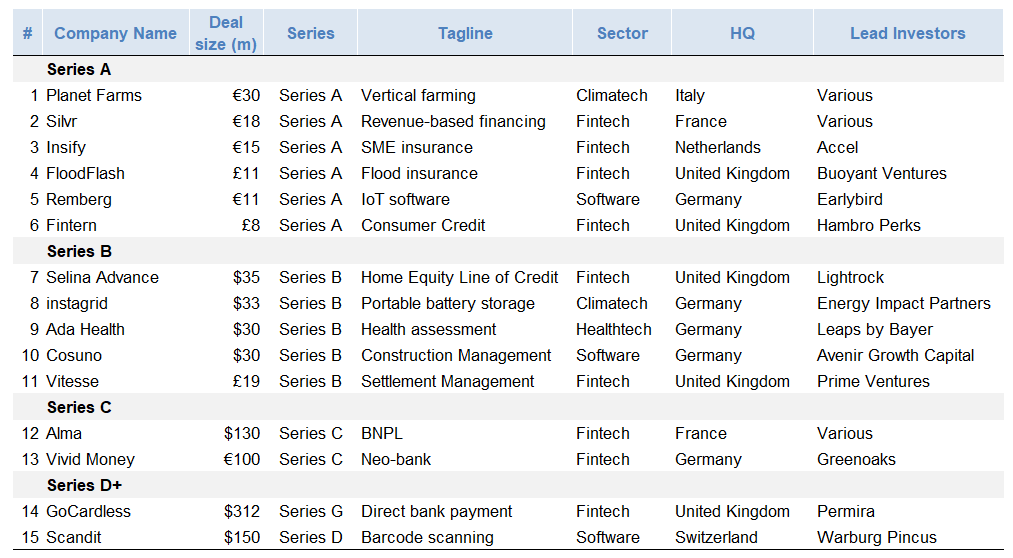

Financing Announcements in Europe by Stage

Note: Minimum round size of $10m; only includes financing rounds with categorized Series/stage

Company Profiles - Series A

Planet Farms (Italy | €30m Series A | Climatech | Various)

Founded in 2018 and headquartered in Italy, Planet Farms is an operator of vertical farms in Italy. It raised €30m in Series A funding from existing and new investors.

The company plans to use the funds for geographical expansion (Italy and abroad) as well as R&D.

Sources: Rinnovabili

Silvr (France | €18m Series A | Fintech | XAnge, Otium, BPIFrance, Eurazeo, ISAI)

Founded in 2020 and headquartered in France, Silvr is a provider of revenue-based financing for e-commerce and software companies. It raised €18m in Series A funding from investors including XAnge, Otium, Bpifrance, Eurazeo, and ISAI. It also announced a €112m debt line.

According to Techcrunch, “Silvr has already financed 100 companies, such as Cuure, French Bandit, Almé Paris and Emma&Chloé.”

Sources: Techcrunch

Insify (Netherlands | €15m Series A | Fintech | Accel)

Founded in 2020 and headquartered in the Netherlands, Insify is an end-to-end digital insurance platform for SMEs in Europe. It raised €15m in Series A funding led by Accel.

Insify has developed insurance products (backed by Munich Re) for SMEs in verticals including e-commerce, leisure, construction, and tech. Distribution channels include direct, embedded insurance (on marketplaces, neobanks, and SaaS platforms) and brokers. Insify is able to offer a business insurance quote in as little as 2 minutes (vs. weeks or months with incumbents) as well as include more data points to ensure tailored coverage that is individually priced.

According to the press release, “Insify has grown rapidly in its first commercial year of operations, already protecting more than 1,500 small businesses in its initial market of the Netherlands. The investment will primarily be used to scale operations and headcount, and expand into new markets in Europe as well as enhancing its underwriting and data analytics capabilities.”

Sources: Techcrunch, Press release

Floodflash (UK | £11m Series A | Fintech | Buoyant Ventures)

Founded in 2019 and headquartered in the UK, Floodflash provides rapid-payout flood insurance. It raised £11m in Series A funding led by Buoyant Ventures.

80% of the world’s catastrophic flood losses aren’t insured, resulting in $58bn of uncovered damage. According to UKTN, the company “combines cloud software, computer models, and IoT sensors to provide its flood insurance cover. After insuring, a mobile-connected sensor is installed at a property. Customers can choose the depth of flooding and payout amount for their policy. When the sensor at their property detects floodwater at the chosen depth, FloodFlash will start the claims process within 48 hours without any documents.”

The company intends to use the funding to focus on international expansion, targeting markets including the US, Germany, Australia, and Japan.

Source: UKTN

Remberg (Germany | €11m Series A | Software | Earlybird)

Founded in 2018 and headquartered in Germany, Remberg is building the XRM system to help companies digitize processes around equipment, such as machines, devices, buildings, and vehicles. It raised €11m in Series A funding led by Earlybird.

According to Startbase, “the start-up has developed software that is intended to enable medium-sized and larger companies to bundle information from customers, contacts, and machines in one place. Subsequently, medium-sized companies are then to plan their offers via the platform instead of in analog form so far. In this way, the start-up wants to position itself in the field of Industry 4.0 and IoT.”

According to tech.eu, “the fresh capital will be used primarily to further expand the areas of sales, product, and engineering.”

Fintern (UK | £8m Series A | Fintech | Hambro Perks)

Founded in 2020 and headquartered in the UK, Fintern is a fintech platform with the goal to enable consumers access to affortable credit. It raised £8m in Series A funding led by Hambro Perks.

Fintern uses open banking to “gain access to a consumer’s spending habits instead of basing the decision solely on their credit score.” The company says “it has processed more than 50,000 loan applications since it launched the service in March 2021. The company claims that over 60% of its customers would not have been approved for a loan using traditional assessment measures.”

Fintech plans to use the “fresh funds to expand its business in the UK and add new members to its team.”

Sources: UKTN

Company Profiles - Series B

Selina Advance (UK | $35m (equity) Series B | Fintech | Lightrock)

Founded in 2019 and headquartered in the UK, Selina is a Home Equity Line of Credit (HELOC) provider in the UK. It raised $35m in Series B funding led by Lightrock. It also raised $115m in debt from GS and GGC.

According to Techcrunch, “homeowners that need capital for a large project (renovation/school fees for children), might otherwise apply for a loan from a bank, or they might refinance their homes to pick up some extra liquidity. Selina’s HELOC approach differs from these in part because of the speed at which its loans are approved — the money can be available as quickly as 24 hours — and the fact that the funds are doled out as needed, meaning consumers are only paying interest on the part they eventually drawn down.”

Selina has issued $100m in loans since its inception.

Sources: Techcrunch

Instagrid (Germany | $33m Series B | Climatech | Energy Impact Ventures)

Founded in 2018 and headquartered in Germany, Instagrid is a provider of portable battery storage to create mobile power infrastructures. It raised $33m in Series B funding led by Energy Impact Partners.

According to Renewablesnow, “Instagrid manufactures off-grid battery systems that enable the use of green electricity in any location and serve as an alternative to mobile combustion engines. Its storage solutions are used to provide reliable electricity supply in sectors such as construction and civil protection or at events. The company claims that its technology reduces carbon emissions by up to 85% over the entire life cycle.”

“The capital from the round will be used to finance the business expansion in Europe and the United States and add more digital services to the company's battery platform to enable the development of smart, customized energy solutions in the future”

Source: Renewablesnow

Ada Health (Germany | $30m Series B extension | Healthtech | Leaps by Bayer)

Founded in 2011 and headquartered in Germany, Ada Health is a digital health platform. It raised $30m in an extension to its Series B round (total round size $120m) led by Leaps by Bayer.

According to Mobihealthnews, “Ada Health is known for its AI-based health assessment and care navigation platform that helps healthcare providers, patients and consumers assess symptoms and digitally navigate care processes.” As of today, the Ada Health app (launched in 2016) has been downloaded by more than 11 million people across 150 countries. Users have completed 23 million assessments using the tool.

Sources: Tech.eu, Mobihealthnews

Cosuno (Germany | $30m Series B | SaaS-enabled Marketplace | Avenir Growth)

Founded in 2019 and headquartered in Germany, Cosuno is a SaaS-enabled marketplace focused on the construction vertical. It raised $30m in Series B funding led by Avenir Growth.

Cosuno’s SaaS-enabled marketplace helps construction companies to find subcontractors, send out requests for proposals, and manage the pre-construction bidding process more productively. With the solution, construction professionals have greater visibility into their purchasing processes and become more efficient in their daily work."

According to Startbase “since its market launch, the software has already handled a volume of $4 billion in the construction context, according to the company. Cosuno plans to put the investment into expanding into new European markets. The startup also wants to drive product development.”

Sources: Startbase

Vitesse PSP (UK | £19m Series B | Fintech | Prime Ventures)

Founded in 2013 and headquartered in the UK, Vitesse PSP provides cross-border payment services to banks and businesses via a globally distributed settlement network. It raised £19m in Series B funding led by Prime Ventures.

Vitesse provides a single connection to a network of domestic clearing systems landing full value payments as quickly as possible and provides a simple, real time view global liquidity to its customer base.

According to UKTN, “Vitesse will use the latest funding to accelerate its offerings and its US and Europe expansion plans. The startup will also invest in its customer service while furthering its product development.”

Sources: UKTN

Company Profiles - Series C

Alma (France | $130m Series C | Fintech | Various)

Founded in 2019 and headquartered in France, Alma is a BNPL platform. It raised €115m / $130m in Series C funding from new investors such as Tencent as well as existing investors such as Eurazeo and BPIfrance.

Alma offers a service that guarantees full payment to the merchant at the time of purchase, while the customer pays over time. Its clients include French upmarket department store chains Galeries Lafayette and Printemps.

The company said it would use the funds to grow in new and existing markets. It plans to expand to the Netherlands, Luxembourg, Portugal, Ireland, and Austria this year.

Sources: Techcrunch, Reuters

Vivid Money (Germany | €100m Seris C | Fintech | Greanoaks)

Founded in 2020 and headquartered in Germany, Vivid Money is a challenger bank with 500k customers. It raised €100m in Series C funding at a €775m valuation (2x since April-21 funding round) led by Greenoaks Capital.

Vivid offers a mobile banking app and a digital investing platform from a single app. Key capabilities include payments, transfers, multi-currency accounts, spendings reports, split bills as well as the possibility to invest in international stocks, ETFs and crypto.

According to Techcrunch, Vivid today is active in four markets (Germany, France, Spain and Italy) and the plan will be to add five more this year, and to be available across all of Europe by the end of 2023.” The company is on target to reach 1 million users by end of 2022. “In terms of new products, the company is in the early stages of rolling out insurance offerings and it will be introducing its first credit products later this year.”

Sources: Techcrunch

Company Profiles - Series D+

GoCardless (UK | $312m Seris G | Fintech | Permira)

Founded in 2011 and headquartered in the UK, GoCardless is a leading fintech in direct bank payment solutions. It raised $312m at a $2.1bn valuation led by Permira.

GoCardless’s product suite makes it easy to collect both recurring and one-off payments directly from customers’ bank accounts through direct debit and open banking. It processes more than $25bn in transactions per year and serves over 70,000 businesses around the world, including DocuSign, Klarna, TripAdvisor, and Epson.

The funding will allow GoCardless to accelerate its growing footprint in the open banking space through both product and geographical expansion as it targets becoming the world’s leading network for direct bank payments.

Sources: Press release

Scandit (Switzerland | $150m Series D | Software | Warburg Pincus)

Founded in 2009 and headquartered in Switzerland, Scandit offers an enterprise mobility and a data capture platform for smart devices. It raised $150m in Series D funding at a $1bn valuation led by Warburg Pincus.

Scandit mobile computer vision software scans any barcode and recognizes text and objects via any smart device’s built-in camera/video feed. Beyond barcodes, the data capture platform also offers Optical Character Recognition (OCR) for mobile apps. It enables users to capture predefined data from sources such as forms, packages, and labels via any smart device’s camera

Sources: Factsheet, Freightwaves

Disclaimer

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.