European Tech Weekly (Series A+ deals) - Week 9

Bonus content: interview with Hendrik Schriefer (CEO at Sharpist)

Welcome to the latest edition of European Tech Weekly, a newsletter that provides a summary of Series A+ funding rounds in Europe on a weekly basis.

This edition also includes an interview with Hendrik Schriefer, who is the Co-founder and CEO of Sharpist, a digital coaching provider that recently raised $23m in Series A funding. He touches on the business model, the recent funding round, and what the future holds. I hope to do more of these interviews to highlight exceptional founders and businesses as well as discuss what it takes to raise capital in the current market. :)

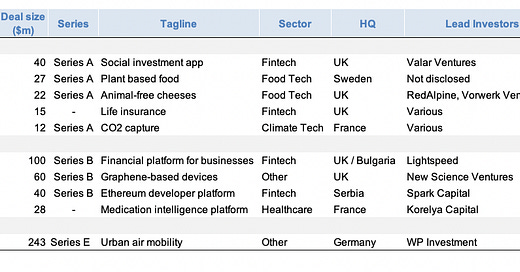

Funding Announcements in Europe by Stage

Note: Minimum deal size of $10m; excludes several sectors such as biotech; non-exhaustive

Company in Spotlight - Sharpist

Sharpist is a results-oriented, digital coaching provider. It recently raised $23m in Series A funding co-led by Endeit Capital and Capnamic. I spoke to Hendrik Schriefer (Co-founder and CEO of Sharpist) and we talked about the business model, the recent funding round, and what the future holds.

To kick off - can you tell us more about what Sharpist offers?

Hendrik: Sharpist helps enterprise clients such as Porsche, Zalando, and LVMH reach measurable business outcomes, such as higher employee retention and productivity. We offer Europe's #1 solution for leadership development, rooted in one-on-one coaching via video call through a network of 1,000+ international coaches. With Sharpist, enterprises can effortlessly scale a leadership culture across their global organizations, via a single, integrated mobile experience for employees.

Can you describe your fundraising journey?

Hendrik: At Sharpist, we are incredibly proud to have partnered with world-class business angels already for our early financing, such as GetYourGuide founder and CEO Johannes Reck and Qunar founder Fritz Demopoulos. These individuals continuously support us, not only in building a global category leader, but also with their network of relevant growth stage investors. Hence, for our Series A round, the interest of the venture capital market in our company has been incredible. We eventually closed an oversubscribed Series A round at $23 million with the two co-leads Endeit Capital and Capnamic. Today, we are proud that we outperformed our pitched business metrics, as the company’s journey post fundraising is much more important than the storytelling beforehand.

What advice would you give to founders that are currently fundraising?

Hendrik: Many investors list the team as a key criterion for their investment decision. While it is important to invest in your team’s relationship as well as your personal presence, for example via coaching, you cannot really control your background and personality, when entering into a fundraise. Similar accounts for your traction. Ideally, you have had a relentless focus on execution and growth, already before raising the new round. Hence, my advice would be to make sure you really understand your market opportunity and outline a tangible plan on how you will capture this opportunity over the coming years. Personally, I like to demonstrate how we will cover the entire value chain in the $300 billion market for people development. Here, my maybe non-consensus mission is to build a company not just for the next five to ten years, but to form an organization that will define the space, even for decades.

Can you elaborate on the decision process of selecting Endeit Capital and Capnamic as as your lead investor?

Hendrik: A key differentiator of Sharpist is our unique user experience. Clients simply love to learn and grow with our coaching and mobile apps so much that they are five times as engaged as they would be on other learning platforms. We are the product innovator on our market, which is why we are the solution of choice for global category leaders and hidden champions, such as LVMH and Palfinger.

When choosing the lead investors for our Series A round it was really important to us that they would be on board with our strategy around product-led growth. Both the teams at Endeit Capital and Capnamic immediately saw Sharpist’s unique opportunity to capture market share, far beyond just coaching and to build a holistic category leader in people development and analytics. Finally, both funds have an extensive track record in bringing success cases global and thereby transforming them into unicorns. This is what they will help us do at Sharpist.

What are some of your goals post this round?

Hendrik: We follow a grand mission to guide every employee in their career from the first internship to retirement. This means, there is quite a journey ahead of us, where we will keep expanding on our holistic people development platform and meanwhile target ever more client organizations across the globe. The next step into this direction will be the opening of our London office for the UK and Ireland region. Equally, we are pretty excited about the extensive analytics suite, which we are rolling out gradually. This will let HR teams track their cohorts’ specific programs on development goals and use Sharpist as a more strategic tool for organizational development.

Company Profiles - Series A

Shares (UK | $40m Series A | Fintech | Valar Ventures)

Founded in 20121 and headquartered in France, Shares is a social investing platform. It raised $40m in Series A funding led by Valar Ventures.

According to Techcrunch, “The company has been working on a mobile app that lets you easily buy and sell shares, but with a social twist. You can follow your friends’ moves and talk with other users directly from the app.”

The company recently launched its app on the App Store and Google Play. “It is only available to people based in the U.K. for now, but the company expects to expand to other European countries in the future.”

Sources: Techcrunch

Mycorena (Sweden | $27m Series A | Food Tech | not disclosed)

Founded in 2017 and headquartered in Sweden, Mycorena is a foodtech start-up that produces plant-based foods based on a unique fungi-based protein ingredient named Promyc. It raised $27m in Series A funding (debt and equity) from undisclosed investors.

According to Nordic9, “the company envisions Promyc to become the protein ingredient of choice for food producers who want more than what the traditional plant-based proteins can offer whilst creating a positive impact on the environment.”

“Funds will primarily be used to bring Promyc from a demonstration-scale innovation with great potential to a commercialized high-value product with great impact.”

Sources: Press release, Nordic9

Better Dairy (UK | $22m Series A | Food Tech | RedAlpine, Vorwerk Ventures)

Founded in 2019 and headquartered in the UK, Better Dairy is a foodtech startup that develops animal-free cheeses using precision fermentation. It raised $22m in Series A funding led by RedAlpine and Vorwerk Ventures.

According to Techcrunch, “Better Dairy is using precision fermentation to produce products that are molecularly identical to traditional dairy. The process is similar to brewing beer, with the end result being dairy.

While other food tech companies are tackling softer cheeses like mozzarella or whey proteins, Better Daily is targeting hard cheeses, a process that is more complex, in a more sustainable way.”

Sources: Techcrunch

DeadHappy (UK | $15m Series A | Fintech | Various)

Founded in 2013 and headquartered in the UK, DeadHappy is a fully digital pay-as-you-go life insurance provider. It raised $15m in Series A funding with existing investors (Octopus and Headline) and new investors (Volution, Verso Capital, Channel 4 Ventures).

According to the company, “more than 230,000 deathwishes have now been made by its customers while the company has sold more than 24,000 life insurance plans to date.”

Sources: Insurtechinsights

CarbonWorks (France | $12m Series A | Climate Tech | Various)

Founded in 2021 and headquartered in France, CarbonWorks is an industrial deep-tech start-up that captures CO2 and converts it into natural raw materials through microalgal photosynthesis. It raised $12m co-led by BNP Paribas Principal Investments, Bpifrance and others.

“To produce bioproducts on a large scale and maximize its impact on the ecological transition, the company is developing a new industrial photobioreactor standard. It will ultimately be capable of capturing several thousand tonnes of CO2 at the source of emission and producing equivalent quantities of algal biomass, intended primarily for the agricultural and human, and animal nutrition markets.

This funding round will provide the start-up with the resources it needs to build a semi-industrial-scale photobioreactor, which it plans to put into service in 2023.”

Source: Press release

Company Profiles - Series B

Payhawk (Bulgaria | $100m Series B | Fintech | Lightspeed)

Founded in 2018 and headquartered in Bulgaria, Payhawk is a financial platform that combines expense management, payments, and invoice management in one solution and therefore works as a one-stop shop for finance teams. It raised $100m in a Series B extension round at a $1bn valuation led by Lightspeed. As a result, Payhawk becomes the first-ever Bulgarian unicorn.

“Currently, finance teams still do a significant amount of manual work due to multiple disconnected tools for cards, payments, invoices, and expense management. Payhawk reduces this by combining those key elements in a single platform.”

The company serves businesses in 30 countries across a variety of industries, currencies, and payment methods.

Payhawk “will use the funds to further grow its product team, double down on its efforts to build best-in-class enterprise features, and expand the sales and marketing team for new market penetration in 2022.”

Sources: Press release

Paragraf (UK | $60m Series B | Other | New Science Ventures)

Founded in 2017 and headquartered in the UK, Paragraf develops graphene-based electronic devices. It raised $60m in Series B funding led by New Science Ventures.

“Paragraf is the first company worldwide to deliver a scalable approach to graphene electronic device manufacturing, by utilizing its unique contamination-free technology. The company’s current products, the graphene Hall Effect Sensor range, are already being used in a wide range of applications across the aerospace, semiconductor, healthcare, automotive, scientific research, industrial, and quantum computing spaces. In addition, the material offers positive environmental impacts such as reduced power consumption.”

The funding will help the company scale the business as it continues its international growth by increasing its sales and technical prowess in the UK, US, EU, and Asia, boosting its R&D capabilities to advance its technology and product development capacity and expanding its manufacturing infrastructure.

Sources: Techcrunch

Tenderly (Serbia | $40m Series B | Fintech | Spark Capital)

Founded in 2018 and headquartered in Serbia, Tenderly is an Ethereum developer platform. It raised $40m in Series B funding led by Spark Capital.

“Tens of thousands” of developers from apps such as Uniswap, Yearn Finance, Circle, Chainlink, Gnosis, Nexus Mutual, Instadapp, DeFi Saver and NFT marketplace OpenSea use Tenderly to monitor the health of the apps and smart contracts. In fact, the company says that it works with the majority of the top 100 Ethereum projects.

“While it declined to reveal hard revenue figures, the company has seen a 500% increase in revenue and a 420% bump in users year-over-year, despite not having “proper expertise in the sales department,” according to Bencic, who credits a “deep connection” with its user base for Tenderly’s success so far.”

The company plans to use its new capital to continue building out its product offerings, toward customer acquisition and partnerships and the hiring of technical and sales talent.

Sources: Press release, Techcrunch

Synapse Medicine (France | $28m | Healthtech | Korelya Capital)

Founded in 2017 and headquartered in France, Synapse Medicine is a Medication Intelligence platform that helps healthcare professionals get reliable drug information and prevent medication errors. It raised $28m in Series B funding led by Korelya Capital

In Europe, adverse medicine reactions account for 8 percent to 12 percent of all hospital admissions. According to Tech.eu, “Synapse Medicine’s proprietary technology pools and organizes up-to-date drug information, ultimately helping both the general public and healthcare providers make better, more informed decisions about which drugs might have an adverse effect on which patients.”

The company plans to grow to 150 employees by the end of the year with offices in Paris, Bordeaux, Berlin, London, New York, and Tokyo.”

Source: Tech.eu

Disclaimer

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.