Welcome to the latest edition of European Tech Weekly, a newsletter that provides a summary of Series A+ funding rounds in Europe on a weekly basis.

About the author - my name is Chirag Modi and I am a tech investor based in London, UK. I am fascinated by technology investing in private as well as public markets and strive to learn from founders, operators, and fellow investors. You can reach me elsewhere on Linkedin and Twitter.

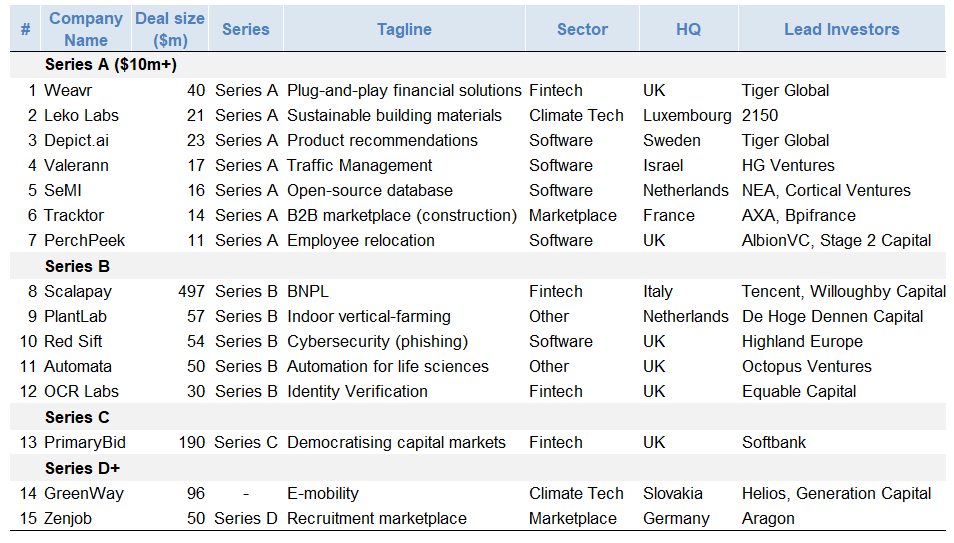

Funding Announcements in Europe by Stage

Note: Minimum deal size of $10m; excludes several sectors such as biotech; non-exhaustive

Company Profiles - Series A

Weavr (UK | $40m Series A | Fintech | Tiger Global)

Founded in 2019 and headquartered in the UK, Weavr is a fintech provider that allows businesses to embed banking and payments into their mobile app or SaaS platforms. It raised $40m in Series A funding led by Tiger Global.

According to Pymnts.com, “Weavr’s Plug-and-Play Finance preconfigures APIs into embedded finance solutions that clients can use without worrying about back-end technology. This differs from most BaaS offerings, which extend a variety of APIs that require high tech demands.”

The financing will support Weavr’s international expansion plans, beginning with an official U.S. market launch.”

Sources: Press release, Pymnts.com

Leko Labs (Luxembourg | $21m Series A | Climate Tech | 2150)

Founded in 2017 and headquartered in Luxembourg, Leko Labs is a construction startup that develops sustainable wood-based building materials as an alternative to steel and concrete. It raised $21m in Series A funding led by 2150.

Currently, “39% of greenhouse gases come from buildings. This represents 8% of global CO₂ emissions. Leko Labs works to replace the concrete and steel of traditional construction with wood (naturally storing carbon) by combining it with robotic manufacturing and AI optimization to move towards full carbon negative construction.”

According to Techcrunch, “the company has multiple construction projects ongoing across its home Benelux region, including homes, offices and data centers (some ongoing projects are visible on its website).”

Leko says the Series A funding will be used to scale its software and robotics construction system throughout Europe — including in Germany, the Nordics and the U.K., while still supplying finished walls from its factory in Luxembourg.

Sources: Techcrunch, LinkedIn post

Depict.ai (Sweden | $23m Series A | Software | Tiger Global)

Founded in 2019 and headquartered in Sweden, Depict is “an AI-based platform that enables any e-commerce store to provide a seamless shopping experience through product recommendations without needing transaction data.” It raised $23m in Series A funding led by Tiger Global.

The software platform “provides Amazon-quality product recommendations for any e-commerce store without needing any historical sales data at all. In order to provide the recommendations, Depict.ai aggregates data by scraping a wide array of sites across the web. ML models are trained on that data and the recommendation engine can then be integrated into its customers’ backends by way of an API. The solution can increase customers’ e-commerce revenue by between 4% and 6%.

Funding will be used to grow the team, enter new markets and invest in the product

Sources: Press release, Techcrunch

Valerann (UK / Israel | $17m Series A | Other | HG Ventures)

Founded in 2016 and headquartered in the UK / Israel, Valerann is a leading provider of advanced traffic management systems. It raised $17m in Series A funding led by HG Ventures.

Its latest product (Lanternn) is an intelligent transportation solution that helps city and highway authorities make more informed decisions around traffic management.

“The investment will support the increasing demand for the company’s software product – Lanternn by Valerann™ – and will enable its implementation with multiple road operators in the UK, Europe and the Americas.”

Sources: Press release

SeMI (Netherlands | $16m Series A | Software | NEA, Cortical Ventures)

Founded in 2019 and headquartered in the Netherlands, SeMI is a developer of the open-source Weaviate vector-search database, which is a core software infrastructure for AI-first applications. It raised $16m in Series A funding co-led by NEA and Cortical Ventures.

“Previous databases just stored raw data; Weaviate stores data that is processed by machine learning models, allowing users to better index and search through their data. The first use cases have been natural-language ones but we are also exploring images, videos, audio, and even esoteric cases such as graph or gene embeddings."

“Weaviate has already been downloaded over 700k times (a number growing about 30% per month). Hundreds of users have applied Weaviate in more than 100 different use cases in technology, finance, media, cybersecurity, health care, and many other industries.”

“The investment will allow SeMI to grow its team, user community, and roster of partners; increase the number of use cases; and to create and fine-tune its ML models and modules.”

Source: Press release

Tracktor (France | $14m Series A | Marketplace | AXA, Bpifrance)

Founded in 2017 and headquartered in France, Tracktor is a B2B marketplace for heavy equipment rental simplifying the day-to-day operations of Construction and Industry SMB. It raised $14m in Series A funding co-led by AXA and Bpifrance.

It digitises heavy equipment rental for Construction and Industry SMBs. Its platform frees its clients of all usual constraints to renting, giving them access to negotiated prices with more than 400 professional renters across France, and centralizing all their rentals to give them more visibility on their expenses.

Tracktor already attracted more than 3,500 Construction and Industry SMBs, enabling them to book in 3 clicks any equipment anywhere in France, saving them up to 3 hours per rental. In continuity with its high growth, the company expects to 3x its revenues in 2022.

This new fundraising will enable Tracktor to hire more highly talented people to double its team by the end of the year. The goal is to become the standard for renting in France and to prepare its international expansion in Europe starting in 2023.

Sources: AXA

PerchPeek (UK | $11m Series A | Consumer | AlbionVC, Stage 2 Capital)

Founded in 2018 and headquartered in the UK, PerchPeek is a digital relocation platform for employers. It raised $11m in Series A funding led by AlbionVC.

Perchpeek is a “step-by-step app that supports employees relocating to 47 countries around the world — including more remote locations, and claims it can save companies up to 70% in relocation costs. It also has experts, available via instant messaging, to guide employees through properties and amenities.”

According to Techcrunch, "since January 2020, it claims to have moved more than 5,000 people. Clients include Thoughtworks, Liberty Global, Impala Travel and INEOS.”

Sources: Techcrunch

Company Profiles - Series B

Scalapay (Italy | $497m Series B | Fintech | Tencent, Willoughby Capital)

Founded in 2019 and headquartered in Italy, Scalapay is a Buy Now, Pay Later (“BNPL”) solution. It raised $497m in Series B funding at a $1bn+ valuation co-led by Tencent and Willoughby Capital. “The company has raised over $700M in funding to date. Since its recent Series A round (announced in Sep-21), Scalapay has grown its payment volume three times month over month.”

It currently operates in Italy, France, Germany, Spain, Portugal, Finland, Belgium, Netherlands and Austria.

Sources: Press release

PlantLab (Netherlands | $57m Series B | Other | De Hoge Dennen Capital)

Founded in 2010 and headquartered in the Netherlands, PlantLab is an indoor vertical-farming business. It raised $57m in Series B funding led by De Hoge Dennen Capital, which is part of the investment arm of the De Rijcke family, the former owners of Kruidvat.

“PlantLab’s technology makes it possible to grow vegetables all over the world, including crops such as tomatoes, cucumbers, basil, and mint. This can even be done on barren soils or in urban areas. Thanks to optimized temperature, moisture, and light regulation, the crops can reach their full potential with a 95% reduction in the amount of water needed and zero use of chemical crop control agents.”

PlantLab says the funds will enable it to open more production sites outside the Netherlands, like North America and Europe.

Source: Press release

Red Sift (UK | $54m Series B | Software | Highland Europe)

Founded in 2015 and headquartered in the UK, Red Sift is a cybersecurity startup. It raised $54m in Series B funding led by Highland Europe.

Products on the Red Sift platform include OnDMARC and OnINBOX, SaaS applications that work together to close the net on the phishing problem by blocking outbound phishing attacks and analyzing the security of inbound communications for company-wide email threat intelligence.

The company intends to use the funds to further accelerate its global expansion with plans for a new US headquarters in Austin, Texas, and growth initiatives across the Asia Pacific, Europe, and Middle East regions, and hire across all departments and double down on its platform innovation.

Sources: Tech.eu

Automata (UK | $50m Series B | Other | Octopus Ventures )

Founded in 2015 and headquartered in the UK, Automata is an automation company helping life sciences rapidly innovate, diagnose and discover at scale. It raised $50m in Series B funding led by Octopus Ventures.

Comprising proprietary hardware (modular pods housing a robotic arm), software and managed services, Automata Labs is a lab automation platform that makes scaling-up accessible for diagnostics labs, drug discovery labs, and to labs of all shapes and sizes. With this technology, life scientists can shorten turnaround times by scaling capacities, and spend more time on their analyses – which also leads to cost reductions.

This Series B investment is on the back of rapid growth for Automata, whose focus on the life sciences has seen nearly a million tests conducted by scientists and clinicians in recent months.

Sources: Press release

OCR Labs (UK | $30m Series B | Fintech | Equable Capital)

Founded in 2018 and headquartered in the UK, OCR Labs is an identity verification provider. It raised $30m in Series B funding led by Equable Capital, which is a New-York based family office founded by Jonathan Smidt (former partner at KKR).

According to Finovate, “boasting a 5x increase in new clients and 3x growth in the size of its team over the past 12 months, OCR Labs offers automated identity verification via ID document validation, facial biometrics and other techniques. OCR Labs’ approach removes the need for human intervention in the customer identification process, and gives companies the tools they need to meet AML and KYC requirements and reduce fraud.”

Sources: Finovate

Disclaimer

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and affiliated persons and companies assume no liability for this information and no obligation to update the information or analysis contained herein in the future.