Veeva Systems: A Vertical SaaS Champion

A $2.4bn ARR software platform for the life sciences industry that only raised $7m (!) in VC funding

If you are building in the space and/or the post resonated with you, please feel free to reach out to me on LinkedIn or via email.

Introduction

Founded in 2007, Veeva is a publicly-listed vertical SaaS platform with a market capitalisation of over $34bn and generating over $2.4bn in annual revenue. It provides cloud software solutions to help life sciences companies bring products to market faster and more efficiently. Despite its size and success, Veeva remains a lesser-known story compared to other large SaaS companies such as Salesforce, Workday and ServiceNow.

In this post, I aim to provide an extensive look at this fascinating business. I have divided the post into five sections: (i) key insights, (ii) company history, (iii) platform overview, (iv) operating and financial metrics, and (v) opportunities for startups.

(I) 10 Key Insights from Studying Veeva

Founding Story

Co-founder and CEO Peter Gassner started Veeva at the age of 42 and is still at the helm after 17 years. Peter's career trajectory includes roles at IBM, PeopleSoft, and Salesforce, where he served as Senior VP of Technology. After leaving Salesforce and taking a two-year break, he decided to return to work with a specific vision. Peter wanted to focus on "something specific to an industry because that would be the next wave after horizontal solutions like Accounting and Payroll." Through a connection with Craig Ramsey (ex-Oracle, Board Member at Salesforce), Peter was introduced to the pharmaceutical industry. The potential impact resonated with him: "On a good day, you're getting people out of a wheelchair."

High Conviction in the Early Days

Peter recalls a pivotal customer interaction from Veeva's early days: "I remember when we started selling CRM, a guy [from the customer's team] stood up and said, 'We have more people in this meeting than you have in your company. Why are we even talking?' I just answered truthfully that we have great people making great technology and this is a chance." This skepticism was pervasive, except among Veeva's internal team and early investors. Critics argued that focusing on a vertical in the cloud was misguided and building on someone else's platform (Salesforce) was even riskier. Peter was warned that this approach would limit exit opportunities.

Reflecting on this period, Peter concludes: "When you start a company, you should try to do something that most people think is a bad idea because, otherwise, it's just too obvious. It would have already been done before. You always want to pick something that most people think won't work because the odds are against you. You've got to get in on something that somebody else is not. I thought pharmaceutical CRM would be good and do it on the cloud and build it on top of Salesforce."

Industry Focus and Hunting Elephants

Veeva's laser focus on the life sciences industry has made it an incredible success story. The founding team combined good understanding of the life sciences and pharma industries with extensive technical expertise in building SaaS applications. From the outset, Veeva targeted the largest pharmaceutical companies as its initial customers. This approach enabled them to build a robust platform tailored to the complex needs of major players in the life sciences industry. Today, Veeva counts over 1,900 customers spending over $1m annually, including the largest pharma and biotech companies globally.

Standing on the Shoulders of Giants until you become a Giant

Peter Gassner's strategic decision to build Veeva on the Salesforce platform allowed the company to focus on industry-specific customisations rather than developing infrastructure from scratch. According to Cyntexa, "leveraging the Salesforce platform enabled Veeva to develop CRM solutions without the need to develop and maintain its cloud infrastructure. This partnership accelerated Veeva's ability to launch products and evolve in response to the growing needs of pharmaceutical companies." As TechCrunch noted, Gassner's experience at Salesforce, where he helped build that very platform, meant he likely knew how to develop software on Salesforce better than anyone at that time.

However, as Veeva grew and evolved, the company made the strategic decision to transition away from the Salesforce platform to reduce dependency on a single vendor and improve its margin profile. Veeva's move to its own Vault platform demonstrates the strategic importance of owning core technology infrastructure for long-term flexibility and margin improvement.

Strong initial wedge and TAM expansion

Veeva's initial CRM product provided a crucial foothold in the industry. However, Peter Gassner envisioned a much broader future - to become the leading cloud platform for the entire life sciences industry. Veeva's second product, a content management solution, was markedly different from its CRM offering. The company leveraged its deep customer relationships and industry knowledge to expand into these adjacent areas. Peter's willingness to take risks and his philosophy of "picking something that you think has a chance of failure" to make great strides has been instrumental in Veeva's success.

As a result of this approach, Veeva's TAM expanded from $1bn to $13bn as it launched new products for the life sciences industry and methodically expanded into clinical, quality, and regulatory areas. The company now sees potential to further expand into a $20bn+ opportunity by 2030, of which they currently have a 12% market share.

Dominate in Your Initial Wedge

Today, Veeva’s CRM suite is used by 80% of the approximately 500,000 global pharma sales reps, providing an exceptionally strong foothold in the market. For context, Salesforce holds roughly 21% market share in the global CRM market. Prior to Veeva, life sciences CRMs were typically hosted on client-server systems, which were often inflexible when updating in the constantly changing regulatory environment within life sciences. While cloud products existed, they failed to meet the industry's specific regulatory and functional requirements. In pharma, CRM products need to include functionalities to meet complex regulatory requirements and streamline compliance process for sales & marketing teams.

Veeva was the first to market with a SaaS cloud-native solution that addressed the major pain points of client-server systems while making operations more efficient and flexible, resulting in approximately 48% cloud cost savings around the time of its IPO. The added benefit of Veeva was its industry-specific nature, which further reduced the traditional client-server system customisation budget by about 10%. In combination, Veeva's cloud-based product specialised for the life sciences vertical was a disruptive technology when introduced, which largely explains its industry-leading market share today.

Platform Play and Land and Expand Strategy

Veeva's entire product portfolio is built on a single unified codebase and data model (the Vault platform). This approach drives higher development velocity, better margins, and faster time-to-value for customers. Furthermore, Veeva has built a highly effective "land-and-expand" strategy that drives much of its growth. Over 85% of new sales come from existing customers. As a result, net retention has consistently been above 120% in recent years.

Product expansion via M&A

Veeva has made over a dozen acquisitions to expand into new product areas and add key talent. When integrating acquisitions, it tends to rebuild products from scratch on the Vault platform to ensure seamless integration. This approach prevents technical debt from creeping in and ensures a cohesive experience for customers. It's worth noting that the vast majority of Veeva's innovation remains organic.

Ecosystem Leverage

Veeva Systems has built a robust partner ecosystem that significantly contributes to its growth and market penetration. This ecosystem includes over 1,000 partners, including top systems integrators and consultancies. Furthermore, the company has implemented a comprehensive certification program to ensure the availability of Veeva experts across its partner network. This program maintains high standards of quality and competency among partners, ultimately supporting customer success. This ecosystem leverage has been instrumental in Veeva's ability to expand its customer base.

Early Profitability and Capital Efficiency

Veeva Systems demonstrated exceptional capital efficiency and early profitability, setting it apart from many other SaaS companies. Veeva reached $45 million in revenue before seeking venture capital funding. The company raised only $7 million in total funding, using just $3 million of it. This includes a remarkably small $4 million Series A round led by Emergence in 2008. This level of capital efficiency is exceptional for a SaaS company that went on to become a multi-billion dollar enterprise.

Furthermore, unlike many SaaS companies that treat professional services as a loss leader, Veeva made this segment profitable from the start. In the early days, professional services was 50% of its revenue, declining to 20% percent today. Professional services drove customer success and resulted in low churn and high NPS with customers.

In essence, Veeva's success can be attributed to several key factors that set them apart from typical SaaS companies. They boldly built on top of the Salesforce platform when this wasn't a common practice. Unlike many software firms that shy away from services, Veeva embraced professional services as a crucial component of their business model, recognising the implementation needs of large enterprises in the life sciences sector. The company also demonstrated remarkable versatility by successfully expanding their product suite from CRM (Commercial Cloud) into R&D (Development Cloud), showcasing a deep understanding of their customers' diverse needs. Veeva's capital efficiency was extraordinary, raising only $7 million before their IPO - a feat almost unheard of for a software company of their scale. As a founder-led business, they maintained a steadfast focus on building a durable company for the long term.

(II) History

Stage 1 (2007-2010): Early Focus on CRM

Veeva was founded in 2007 by Peter Gassner and Matt Wallach, leveraging their experience from Salesforce and Siebel Systems, respectively. They identified an opportunity to bring cloud computing benefits to the life sciences industry, which was still heavily reliant on on-premise software.

Veeva's initial focus was developing a CRM system tailored specifically for life sciences companies. The Veeva CRM product was built on the Salesforce platform, allowing for rapid market entry and leveraging Salesforce's existing security and scalability features.

Key milestones:

2007: Veeva founded; CRM launched; $3 million raised from angel investors

2008: $4 million Series A round from Emergence Capital (+300x return and reportedly returned Emergence Fund II more than 7x over)

2010: Reached 100 employees; opened first international office in Barcelona

Stage 2 (2011-2014): Expanding Beyond CRM into Content Management. IPO

As Veeva's CRM business gained traction, the company identified additional areas where cloud software could drive efficiencies for life sciences companies. A key pain point was managing the large volume of regulated content (e.g., SOPs (Standard Operating Procedures), trial master files (TMFs), submissions) that these companies produce.

To address this need, Veeva launched its Vault platform in 2011. Vault was designed as a content management system specifically for life sciences, featuring granular access controls, audit trails, and e-signature support. The first Vault application was eTMF (electronic trial master file), followed by Vault Submissions.

Key milestones:

2011: Vault platform and eTMF launched

2012: Vault Submissions launched

2013: Veeva IPO, raising over $260 million at a $4.4 billion valuation

Stage 3 (2015-2018): Expanding Vault into Quality, Safety, and Commercial Content

With the Vault platform established, Veeva rapidly expanded its application suite into other areas of the value chain. The company launched Vault QualityDocs (2015) and Vault QMS (2016) for quality management, Vault Safety (2017) for drug safety and pharmacovigilance, and Vault PromoMats (2016) for commercial content management.

Veeva also began making strategic acquisitions to complement its organic product development. The company acquired Zinc Ahead (2015) for its Zinc MAPS software, which became Vault MedComms, and Octagon Research (2017) for its EDC and eSource capabilities.

Key milestones:

2015: Vault QualityDocs launched; Zinc Ahead acquired

2016: Vault QMS and Vault PromoMats launched

2017: Vault Safety launched; Octagon Research acquired

2018: Reached 2,500 employees; opened offices in Frankfurt, Sao Paulo, and Seoul

Stage 4 (2019-2022): Building the Data Cloud and Becoming a PBC

In 2019, Veeva made its largest acquisition to date with the $430 million purchase of Crossix, a leader in privacy-safe patient data and analytics. This marked the beginning of Veeva's "Data Cloud" strategy, aimed at helping life sciences companies generate insights across the product lifecycle by connecting data from multiple sources.

Veeva also converted to a Public Benefit Corporation (PBC) in 2019, becoming the first publicly traded company to do so. This move codified Veeva's commitment to all stakeholders (customers, employees, partners, shareholders) into its legal charter.

On the product front, Veeva continued to innovate with the launch of MyVeeva (2020) for patient engagement, Veeva Link (2020) for real-time intelligence on key people and organizations, and Veeva Data Cloud (2021) for longitudinal patient data.

Key milestones:

2019: Acquired Crossix; became a PBC (Public Benefit Corporation)

2020: Launched MyVeeva and Veeva Link

2021: Launched Veeva Data Cloud; reached $1 million in annual revenue (14 years after launch)

2022: Surpassed 5,000 employees globally

Stage 5 (2023 and beyond): AI and the Quest for $5bn ARR

As Veeva enters its next chapter, the company is heavily focused on incorporating AI into its products and driving towards its goal of $5bn in annual revenue by 2030. The company has made several AI-related announcements including Veeva Vault Generative AI (2023) for embedded AI assistants and Veeva CRM Suggestions (2023) for AI-driven rep coaching.

Veeva is also in the process of migrating its Commercial Cloud suite from Salesforce to its own platform. This multi-year journey is expected to give the company more flexibility and control over its CRM roadmap in the long run, as well as significantly improve its margin profile. Several analysts estimate that Veeva has paid as much as 15% (!) of its revenue as the platform royalty fee to Salesforce.

Key milestones:

2023: Launched Vault Generative AI and CRM Suggestions; announced Salesforce to Vault CRM migration

2024: Topline reaches $2.4bn with 1,000+ customers, including 18 of top 20 pharma companies

2025 target: $3bn+ in annual revenue

(III) Platform Overview

Veeva's product portfolio is built on three main platforms:

Veeva Development Cloud “Vault” is its proprietary content management platform that enables life sciences companies to manage content and data from R&D through to commercialisation. It broadens Veeva’s addressable market to include IT dollars dedicated to R&D organisations and content management platforms.

Veeva Commercial Cloud is its CRM offering (initial wedge/first product) and supports life sciences company’s sales & marketing activities.

Veeva Data Cloud provides customer reference data, real-time intelligence and prescriber and sales data from the US market. It is essentially built on existing technology from Crossix, a privacy-safe patient data and analytics company that Veeva acquired in late 2019.

Commercial Cloud and Development Cloud (“Vault”) serve as the foundational layers on which Veeva has built a comprehensive set of applications tailored for the life sciences industry. Let's dive deeper into each of these clouds and their key products.

Veeva Development Cloud

Development Cloud is Veeva's proprietary cloud-based content management platform that was first introduced in 2011. It serves as the foundation for Veeva's applications outside CRM. Vault is purpose-built for the life sciences industry and provides (a) Document & data management, (b) Collaborative authoring, (c) Controlled processes & workflows and (d) Audit traceability

Key products built on the Vault platform include:

a. Clinical Operations Solution includes Vault eTMF, CTMS , Study Startup (speeds up site activation process. Site Connect (Enables site document exchange), eConsent (Paperless patient consent). As of 2023, Veeva has 18 of the top 20 pharma companies utilise Veeva eTMF.

b. Clinical Data Management Solutions includes Vault EDC (Electronic data capture), Vault CDMS (Clinical data management system), Vault Coder (Medical coding application), Vault RTSM (Randomisation and trial supply management), Vault ePRO (Electronic patient-reported outcomes)

d. Regulatory Solutions includes Vault Registrations (Product registration data), Vault Submissions (Regulatory submissions), Vault Submissions (Publishing) and Vault (Submissions Archive)

e. Safety Solutions includes Vault Safety (Pharmacovigilance and safety system), Vault SafetyDocs (Safety document management), Vault Workbench (adverse event case intake) and Vault Signal (Safety signal detection)

f .Quality & Manufacturing Solutions includes Vault QMS (Quality management system), Vault QualityDocs (Document control), Vault Training (Learning management), Vault Station Manager (MES and device history)

A comprehensive set of product demos can be found here.

Veeva Commercial Cloud

Veeva Commercial Cloud is a suite of applications that helps life sciences companies more effectively and efficiently commercialise their products. The key products under this cloud are:

CRM Suite

Medical: Medical comms and enquiry management

Marketing: Commercial content management and marketing automation

Crossix: Privacy safe patient data for marketing analytics

Patient: Patient CRM

A comprehensive product demo of Commercial Cloud can be found here.

Industry-Specific Clouds

In addition to its core product lines, Veeva has introduced several industry-specific solutions that package together relevant applications for certain industry segments:

Veeva MedTech: Quality, regulatory, and commercial solutions for medical device manufacturers

Veeva Consumer Goods: Quality and commercial solutions for the consumer goods industry

Veeva Chemicals: Quality, regulatory, and compliance solutions for chemical companies

By creating these industry-specific clouds, Veeva can more effectively market and sell to these adjacent industries that have similar regulatory and quality needs as life sciences.

Product Maturity Profile

Veeva’s CRM suite is more mature and was the primary driver of growth in the first 3-4 stages of its lifecycle. The core CRM product has >80% share of seats with the remaining market share more fragmented between IQVIA and smaller point solutions. Veeva has consistently build out its CRM suite with add-on products and it is a very sticky platform with gross churn estimated to be <5%. Going forward, analysts expect Clinical Data, Clinical Ops and Safety to drive future growth.

On new product development, Veeva is patient with incubating new products, starting with dedicated teams of around a dozen people and giving them 1-2 years before expecting significant revenue contribution. This allows enough time and resources for products to find product-market fit.

(IV) Operating & Financial Metrics

Revenue and revenue growth

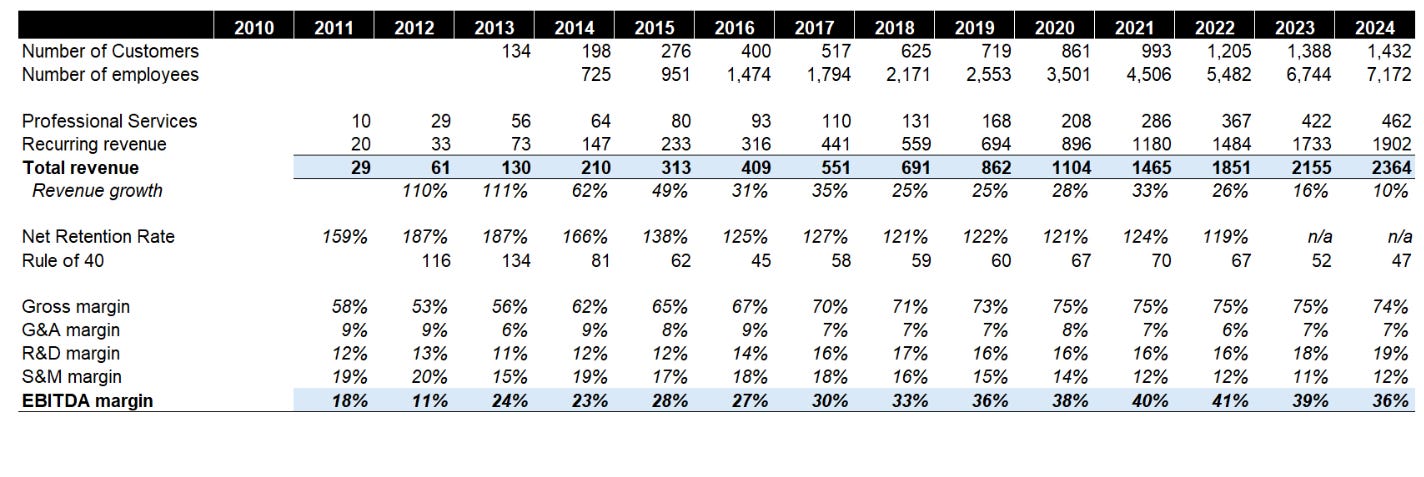

Veeva has demonstrated consistent and impressive revenue growth since the early days. Total revenue grew from $29m in FY2011 to $2.4bn in FY2024, representing a whopping 40% CAGR over a 13-year period.

Part 1: Land. Veeva currently has c.1.4k customers doing is adding c.140 customers (3y average) in this bucket albeit the new logo growth has considerably slowed down due to competition as well as already high market share in its core segment (pharma).

Part 2: Retain. Service has a best-in-class logo retention because it targets enterprise customers in life sciences and is considered a mission critical product.

Part 3: Expand with cross-sell & upsell. Veeva has exhibited c.120% net dollar retention rates driven by high attach rates.

In the R&D segment, the average number of products per customer increased from 2.25 in FY19 to 3.02 in FY23. In the commercial segment, the average number of products per customers increased from 3.25 in FY19 to 4.02 in FY23. In both segments, the majority of the customers were using 3 products or fewer, implying significant runway to cross-sell to the existing install base.

Profitability and Rule of 40

Veeva has also demonstrated strong and improving profitability over time. Non-GAAP operating margins expanded from 36% in FY2019 to a peak of 41% in FY2022, before moderating slightly to 38% in FY2023

Veeva's strong profitability at scale is a testament to its highly efficient operating model. The company's ability to maintain 35%+ EBITDA margins while still investing for growth is impressive. On the rule of 40, the company has historically scores an impressive 60+ in historical years although it is trending down to 47 this fiscal year.

Valuation

$5bn in total revenue by 2030, implying a ~13% CAGR from FY2023

Operating margins of 35-40% over the long term

From a valuation perspective, Veeva currently trades at:

~10x EV/Revenue on FY2025 revenue

~25x EV/EBITDA on FY2025 EBITDA

~33x P/E on FY2025 Earnings

(V) Opportunities for Startups

Veeva is a incredibly successful vertical SaaS business in a regulated market. Whilst it is somewhat challenging to build a competitor given Veeva’s dominance, I do think there are some interesting areas worth exploring:

Patient engagement solutions

The clinical patient engagement solutions market is relatively new compared to clinical operations and data management markets. There remains whitespace for growth as pharma companies adopt more digital methods of patient engagement. Key solutions in this segment include:

Electronic Clinical Outcomes Assessment and electronic Patient Reported Outcomes (eCOA & ePRO)

eConsent for digital patient consent to clinical trials

eSource for digital data collection and connections

The value proposition of these solutions is enabling digital data intake, improving standardisation, and facilitating virtual participation, which can improve trial patient retention and logistics.

Quality, regulatory and safety

Quality

The pharma quality management sector has been transitioning from paper documentation to digital over the past 20+ years. Key drivers include changing quality standards, the need for efficient quality management to reduce costs and speed up timelines, and an increase in reference documents.

The key solution in this area is a Quality Management System (QMS), which has a range of capabilities depending on the company, but common capabilities include quality document management, Corrective Action and Preventive Action (CAPA) management, and training management

Regulatory

A common solution purchased would be a Regulatory Information Management (RIM) product, which works to organise and streamline global regulatory approval processes and increase the accuracy of information in regulatory compliance activities. This is increasingly important since companies struggle to keep up with ever-changing regulatory requirements, with IQVIA finding over 47 countries have unique disclosure regulations in place. On top of this, requirements change consistently within individual countries, with IQVIA reporting the FDA has created or modified over 2,000 regulations since 1998 (as of 2019)

Safety

The industry is experiencing an acceleration in demand for high-tech solutions as the pandemic increased the number of adverse events in the healthcare system, with the European Medicines Agency reporting a 93% increase in adverse event volume in 2021 vs. 2020. This quickly made the manual and fragmented process of reporting safety cases to health authorities antiquated (IQVIA has found 70% of safety team budgets are spent on case processes), necessitating the adoption of modern safety solutions in the healthcare market, which historically has been slow to adopt new technology. As a result, pharma will likely have to adopt AI-enabled pharmacovigilance solutions with a “human in the loop ̇in the coming years.

Data & Analytics

Life Sciences data is vast and can include sales targeting data, prescription data, and claims data. Key categories include claims data, prescription data, reference data, and Electronic Health Record (EHR) data.

Differentiation in this market relies on data uniqueness, scope, and the ability to glean actionable insights.

RWE solutions

Real world evidence (RWE) is the clinical evidence regarding the usage and potential benefits or risks of a medical product derived from analysis of real world data (RWD). RWE can be generated by different study designs or analyses, including but not limited to randomised trials, including large simple trials, pragmatic trials, and observational studies (prospective and/or retrospective). Practically speaking, a use case of RWE could be to design secondary control arms of studies, which would create essentially a data-driven placebo group for a study. This could eliminate the need for an actual placebo group, which would both save costs and alleviate potential ethical concerns

Healthcare advertising

Traditionally, life sciences advertising included sending drug samples to doctors, putting advertisements in the newspaper, or leaving brochures out in doctors˖ offices, to name a few. However, due to continued innovation, digital advertising in healthcare has become more pervasive, with spend growing ~37% in 2021, according to eMarketer .

A host of companies are purpose built to help direct marketers when spending across channels. These companies can help in audience targeting, campaign planning, and ROI measuring and optimisation. This can be a complex process, as key decision-makers often have to weigh focusing on quality targeting, cost, and reach, and traditionally there have not been many relevant HIPAA compliant means to balance the three facets. On top of that, many of these companies help marketers on the back end of campaigns to measure performance by tracking script lift. This leaves a lane for companies to partner with marketers to help manage this function, which is a growing business model in the life sciences advertising market

Revenue management solutions

The revenue management solutions industry for biopharma offers pricing solutions to meet regulatory requirements and acts as a source of record to track the payment of rebates and incentives. This is a challenge due to the size and complexity of the life sciences industry, and companies within this space must manage relationships with various groups and organisations, including GPOs, MCOs, and a number of distributors. These relationships require the use of different contracts and agreements, complicating the revenue management cycle for life sciences companies.

Additionally, there may be opportunities to build quality management and regulatory compliance solutions in the consumer goods and chemicals verticals, areas where Veeva is beginning to focus but doesn't yet have significant market share.

Thanks Akshat, Karan, Alexandre for reading the drafts and providing invaluable feedback.